When I wrote about Three small cap SuperStocks worthy of further research last year, a subscriber, sevenccc, responded by saying:

…there is one big but for all 3 from my perspective. Low Operating Margins. Does this not concern you? To me this largely invalidates the Quality scores, which are all 80+. Is that unfair?

This thoughtful comment has stayed with me. Are low operating margins a sign of a poor business to be ignored, or is that already in the price and then some? The good news is I’ve now been able to test this empirically.

Operating Margin

Before I go into the details, here is a reminder of what the operating margin is:

Operating Margin = Operating Profit / Revenue = (Revenue – Operating Costs) / Revenue

The operating profit excludes taxes and interest payments and allows investors to compare businesses regardless of how they are financed or conduct their tax affairs. A business with a low operating margin has a minimal difference between the revenue it generates and the costs of those sales. A low-margin business works very hard to eke out a small profit. It is likely to operate in highly competitive industries. Typical low-margin businesses include distributors, such as NWF (LON:NWF) , or contractors, such as Balfour Beatty (LON:BBY) . It is often said that contracting businesses are always one onerous contract away from insolvency. While this may be an exaggeration, the low operating margins mean that any slip-up can have a big impact on the profitability of such companies.

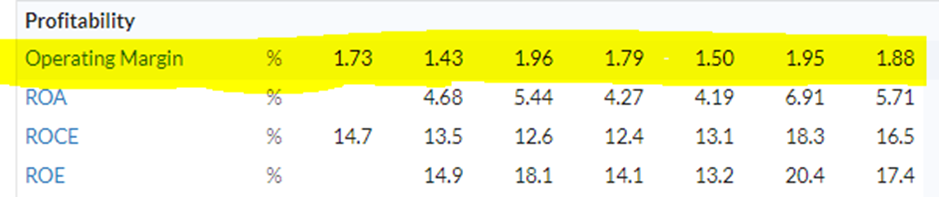

The operating margin figure can be found on the StockReport here:

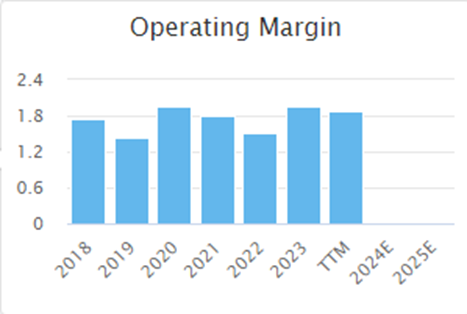

And graphically, like this:

In this example, which is from the StockReport from NWF (LON:NWF) , the operating margin is never above 2%, reflecting their fuel and feed distribution operations.

On the surface, it makes sense to avoid these types of businesses. However, investing is one of the fields that confounds conventional thinking. The reason for this is that every investment opportunity doesn’t just consist of what an investor buys into but also what they pay for it. This is at the heart of the Value Investing anomaly – where cheaply-rated stocks have outperformed highly-rated ones over the long term. Everyone wants to own well-managed companies with great products in exciting, growing industries, and no one wants…