Good morning! It's a very quiet day for news today, indeed the whole week looks as if it will be quiet. I published another webcast last night, of me telephone interviewing renowned investor David Stredder, so for anyone interested in our ramblings (reviewing the previous week's company results, and previewing this week's), the link is here.

Investor webcasts are great fun to do, so it will be a regular Sunday evening feature - not for any commercial reason, I just enjoy doing them. This Sunday coming I will be interviewing ISA millionaire Leon Boros, who in my view published the best ever post on Stockopedia - here.

Management Consulting (LON:MMC)

Share price: 20p

No. shares: 496.0m

Market Cap: £99.2m

This is the biggest faller of the day, down 21.6%, so there must be a profit warning out.

Profit warning - the key paragraphs in today's trading update is this;

The outlook for the business for the year as a whole has deteriorated from the position set out in our Interim Results statement on 31 July 2014, principally as a result of weakness in Alexander Proudfoot, and as a result the Board has materially reduced its profit expectations for 2014.

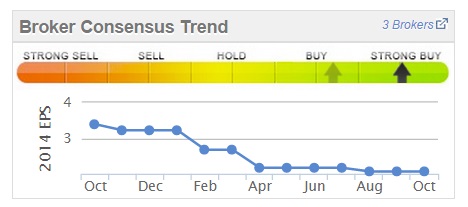

It's interesting to note that Stockopedia's "broker consensus trend" was flagging up risk here, with a steadily declining reading over the last year.

I'm not gong to drill in any deeper, as I don't like this share - it fails my Balance Sheet testing in particular, with negative net tangible assets, and too much debt. Usual thing - a firm of advisers that tells other people how to run their companies whilst not doing a very good job of running their own! This type of firm always seems to take on far too much debt - remember the two Listed firms of auditors that went bust? (RSM Tenon and Vantis).

I'm not suggesting that MMC is likely to go bust, but it certainly has too much debt, and tacitly admits that in today's announcement, when it says;

Reported net debt at the half year stage was £48.0m. Whilst levels of indebtedness are currently higher than the half year position as a result of the slower summer trading period and weakness in Alexander Proudfoot, the Group continues to focus on operational cash generation to further reduce net indebtedness over the course of the current financial year.

There's a risk that this might put the divis under threat. Last year the company paid 0.83p in divis, so that's a yield of 4.2%, but I wouldn't hang my hat on that, as highly indebted companies shouldn't really be paying divis at all, and there's a considerable risk that the divis might be cut or cancelled altogether.

My opinion - I'm generally not keen on people businesses such as this - as the best people tend to either leave and set up on their own, or demand ridiculously high salaries. There's very little to appeal about this share - poor current trading, a weak Balance Sheet, divis that might be under threat, too much debt, etc. It doesn't even look good value either, so a firm thumbs down from me.

Sweett (LON:CSG)

CEO resigns - An announcement today says that the CEO has resigned with immediate effect. This is presented as him having "brought forward his planned retirement date".

This company has been mired in serious trouble, being investigated by the authorities in both the UK and USA. So the sudden departure of the CEO is not likely to be the precursor to good news, is it?

I've added it to my bargepole list - very high risk in my opinion.

Proactis Holdings (LON:PHD)

Share price: 89p

No. shares: 38.8m

Market Cap: £34.5m

This is a small software group. I don't recall looking at it before, but checking the archive I did review it on the publication of a positive trading statement on 12 Aug 2013 when the shares were just 24p. They've risen spectacularly since then, and now stand at 89p.

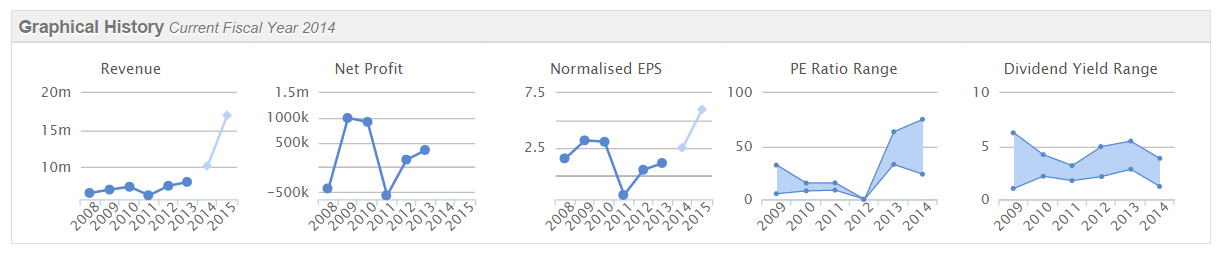

The reason for the huge share price rise seems to be that a number of acquisitions have been done, so that this rather sleepy micro cap company is now suddenly a growth company, as you can see from the Stockopedia graphics below - note how the forecasts show big rises in sales & profits.

Preliminary results for the year ended 31 Jul 2014 are published today, so I've had a quick skim through of the numbers, but not read the narrative.

It's the same old problem with many software companies - they report a big EBITDA figure, £2.0m in this case, up from £1.2m in 2013, but if you look at the cashflow statement, most of the EBITDA is swallowed up in capitalised development costs. So the company isn't really making very much profit at all, on the basis that I view things - i.e. after expensing all development spend because it's just internal payroll, and is ongoing. Just because the company happens to call those costs "development" doesn't mean that the tooth fairy picks up the tab!

Profit before tax was only £146k for the year! Although that is stated after various highlighted items, such as £532k of non-recurring costs, and a couple of other smaller items.

Balance Sheet - the company says it's strong, but it isn't, it's weak. Write off the intangibles, and net assets becomes negative, at -£5.8m. The current ratio is poor, at 0.76 (I look for at least 1.2, and preferably 1.5+).

Dividends - an increase from 1.0p to 1.1p is indicated today, but that is only a 1.2% yield. It can't pay out more, because it's not generating any significant cashflow!

My opinion - I can't see anything attractive at all in these numbers. The company looks significantly over-valued in my opinion. However, it might be the type of company where investors are buying into the future potential of the company, rather than its current figures. I've not looked into that side of things, so can only comment on the figures, which are unimpressive at this valuation in my view.

That said, looking at the chart below, I don't suppose investors here give two hoots what my view is, as they've been laughing all the way to the bank in the last year!

I shall leave it there for today, as nothing else of interest has come up on my radar.

See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may have positions in companies mentioned in these reports)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.