Good morning! It's that time of day when I think to myself, right, better turn off Twitter and stop ticker-watching, and actually write something!

Incidentally, I updated yesterday's report in the evening for the trading updates from;

Majestic Wine (LON:MJW)

Escher Group (LON:ESCH)

Topps Tiles (LON:TPT)

As well as previous comments on Boohoo.Com (LON:BOO)

So to review yesterday's full report please click here.

Crawshaw (LON:CRAW)

Share price: 48.25p

No. shares: 79.6m

Market Cap: £38.4m

Trading update - as this small butchers chain has put out a Christmas trading update, I'm guessing that this must be their peak trading period - presumably driven by sales of turkey, and all the other meat we feast on over the festive season.

It's a bit of a mixed bag. The key point is that trading over the 9 weeks to 28 Dec 2014 was "in line with management expectations". That's good. However, LFL sales were actually down 3%, but they say this was expected, due to exceptionally strong sales last year (up 21%).

Gross margin improved by 100 basis points, which offset the fall in sales, so positive there.

Year to date LFL sales are up 6%, but the growth rate has slowed throughout the year, and is now negative.

Valuation - we already know why this share looks so expensive in the short term - it's because the valuation is anticipating a substantial roll-out of new stores. The company is, I believe, intending to open 10 new stores in year 1, then 20 new stores annually thereafter. They won't find that easy though - I've done a retail roll-out myself, of similar scale, and it's a nightmare to manage, but it can be done.

So really, it doesn't make a lot of sense to look at the near term figures for PER, etc. However, for the sake of completeness, the house broker has today confirmed its estimate of £1.0m profit (EPS 1.1p) for the current year, which is about to end shortly, on 31 Jan 2015. That gives a PER of 43.4.

The broker is then forecasting a fall in profit next year, to only £0.6m (EPS 0.6p), due to up-front costs needed in infrastructure to support the future store roll-out plan. So again, doesn't make sense to value the company on that figure, but it works out at a PER of just over 80.

However, once the new stores kick in, then profits should rise considerably, and rapidly from 2016/17 onwards.

My opinion - this investment is all about the roll-out of new stores - and remember they already have the cash in the bank to do about 20. So investors will need to be patient as the new (ex-Lidl) CEO starts opening those new stores, and much higher profit should then flow through.

If you're prepared to be patient, and hold for a couple of years, there could be good upside, since if the roll-out is going well by 2017, then the market will be anticipating a lot more new stores beyond that into the valuation.

I can see the attraction, but for my tastes the up-front premium now is a bit too high. Also, I'm surprised that the existing stores seem to have now hit peak sales, it's odd to see a 3% decline in sales over the busy Xmas period. That suggests to me that possibly some business is returning to the supermarkets, who are now locked in a serious price war? Maybe that could chip away at the competitive position of Crawshaws? Although it should be emphasised that Crawshaws does a broader offer, including hot food.

Personally I'll watch from the sidelines, and if I get comfort that the roll-out is working, then I might dip in and buy a few. That's not a certainty though, as the company's record to date has been of only very modest profitability. Therefore the key question is whether they can boost profits by operational gearing kicking in, with more store numbers?

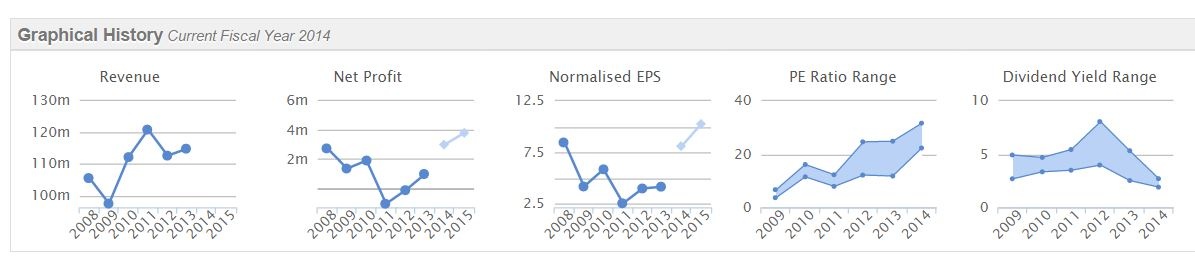

Interquest (LON:ITQ)

Share price: 103.8p

No. shares: 34.4m

Market Cap: £35.7m

Trading update - from this IT recruitment company reads well. Here are the highlights;

It's unusual to quote EBITA, so basically operating profit with the intangibles amortisation charge removed. That immediately makes me wonder, what are they trying to hide?! So I'll have a look at the last set of figures, and see if I can find any funnies.

Right, I've looked through the last set of interim results to 30 Jun 2014, and they look alright - i.e. nothing funny is going through intangibles, it's mainly goodwill, which I'm happy to ignore both on a Bal Sheet basis, and in terms of the amortisation charge going through the P&L. There is a small amount capitalised for customer relationships, but that relates to an acquisition, and you often see such intangibles created at the time of valuing the net assets of an acquired company.

So having checked, I'm happy to accept the company's reporting EBITA as being a fair way to measure profitability. The only exception being share based payments, which I don't accept should be ignored, since it's employee remuneration, and therefore needs to be recognised as a cost of running the business by going through the P&L.

Balance Sheet - I'm rambling a bit now, let's wrap this up. The Bal Sheet isn't great, with minimal net assets, and a working capital position that relies on some bank debt to support the debtors, which in fairness is par for the course in this sector.

My opinion - I like the Directorspeak in today's announcement, which sounds upbeat, and points out that the company is in a good niche sector.

Overall, it looks a quite good business, and seems to be performing well, and the valuation looks reasonable, so this one might be worth some further research.

Although note my comments here on 23 Dec 2014 relating to an aborted sale process of the company, which could put a dampener on the share price perhaps?

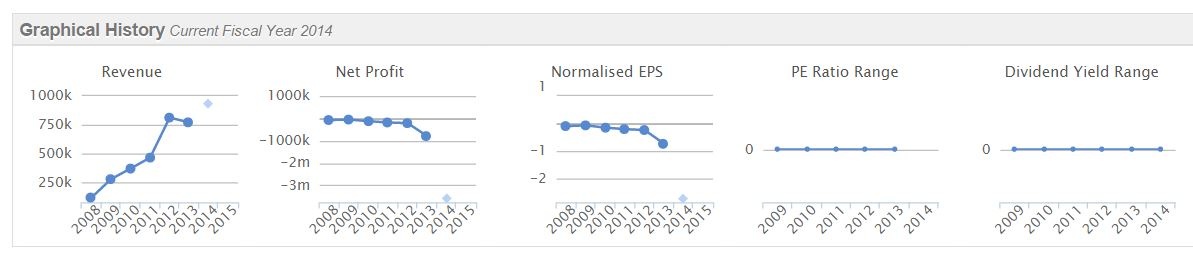

Forbidden Technologies (LON:FBT)

Share price: 9.5p

No. shares: 131.8m

Market Cap: £12.5m

Strategic update - this micro cap video software company is scaling back its operations in the USA, realising cost savings of £1.4m in 2015.

As you can see from the Stockopedia graphics below, the company has never achieved any scale, with turnover still shy of £1m p.a.. The Business Development Director of 13 years is also moving on.

Sometimes good products just can't reach critical mass, without a huge & speculative investment in sales & marketing. Maybe this is such a product?

My opinion - I've never understood why the market cap got anywhere near as high as it did, and actually the shares still look expensive, with a £12.5m market cap. Maybe they should sell the company to a bigger group? It's difficult to see how going it alone makes any sense now.

That's it for today. See you in the morning!

Regards, Paul.

(Paul has no long or short positions in the companies mentioned today, but a fund management company with which Paul is associated may hold positions in companies mentioned here)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.