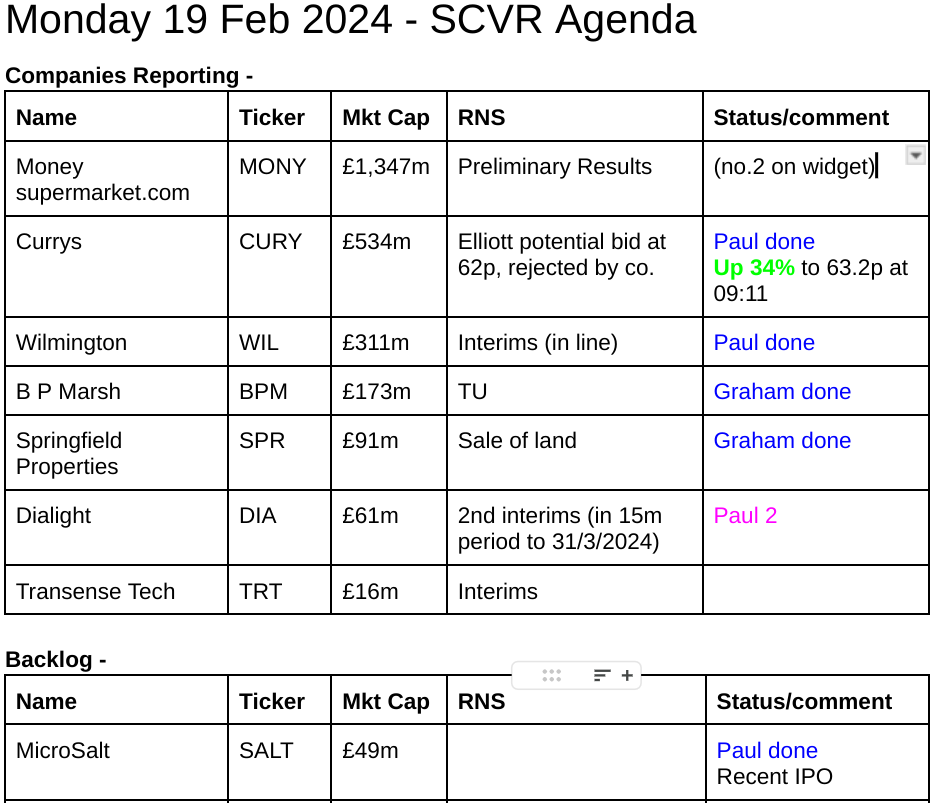

Good morning from Paul & Graham!

Mello Monday starts tonight at 17:00. Note that our Graham is on the BASH panel, should be fun!

The Week Ahead - this excellent new Stockopedia editorial is out every Monday morning, and is the place to discuss UK & overseas larger caps. Good idea, as we get a bit too congested here! Megan normally writes these, but today it's from Keelan, covering banks, miners, Rolls-Royce Holdings (LON:RR.) and more.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news) -

Petards (LON:PEG) (nanocap £4m) - up 15% to 6.7p - announces a £0.35m order from another police force for its ANPR product. Patchy track record, some years it makes a small profit. Healthy balance sheet. Could be worth a speculative look maybe?!

Esken (LON:ESKN) (nanocap £2m) - down 49% to 0.2p - death throes of equity continue. Bond holder is trying to force a restructuring, meaning ESKN would cede control of Southend Airport. Top 3 shareholders are (amazingly) Toscafund, Harwood, and Richard Griffith. One way or another, existing small shareholders seem likely to be wiped out, probably.

Atome (LON:ATOM) - down 9% to 51p (£16m) - placing at 50p to raise £1.8m, £665k coming from Directors & PDMRs. It’s a pre-revenue heavy cash burner, so high risk. It’s developing green fertiliser projects. Good luck to everyone involved.

Spaceandpeople (LON:SAL) - up 9% to 64p (nanocap £1.4m) - FY 12/2023 TU - sounds OK (edit: actually, quite good considering the tiny mkt cap) -

“The Board is pleased to report a strong performance during the second half of FY23, with total unaudited revenue for FY23 being slightly above market expectations, at approximately £5.8 million (2022 restated: £4.7 million), due to particularly strong Brand Experience revenue, the successful launch of our Rock Up and Pop Up service and the continued recovery and expansion of our German retail business.”

Net cash £0.8m. Why is SAL listed, surely makes sense to take it private at this minuscule mkt cap? Zeus reckons it’s trading just above breakeven, update note out this morning, available on Research Tree. So it doesn't look a basket case, speculative upside maybe? Erratic performance, and a serial disappointer in the past, we've followed this one for many years.

Summaries

Currys (LON:CURY) - up 34% to 63.2p (£716m) - Potential bidders - Elliott (at 62p - rejected) & JD.com - Paul - PINK for spreadsheet - AMBER on fundamentals

Weekend newspapers (and since confirmed on this morning's RNS) say Elliott (one of the world's largest activist investors, from USA) made a 62p takeover approach to CURY management, which they have rejected as undervaluing the company. JD.com also apparently sniffing around, CURY now in play.

MicroSalt (LON:SALT) - 114p (£49m) - Recent AIM float - Paul - AMBER

I review the AIM Admission Document below for this recent float, which has gone to an unusually large premium. Very much a jam tomorrow company, with negligible sales to date, but it's a nice story!

B.P. Marsh & Partners (LON:BPM) - unch. at 466p (£173m) - Trading Update - Graham - GREEN

This investor in small insurance brokers and agents had a remarkable 2023, making disposals of various investments for £93m of upfront cash. Larger dividends and share buybacks are underway but the stock remains at an 18% discount to last-reported NAV.

Springfield Properties (LON:SPR)- up 1% to 77p (£91m) - Sale of land - Graham - GREEN

This Scottish housebuilder announces the sale of land, consistent with its strategy to dispose of parts of its landbank in order to pay down debt. It will announce interim results tomorrow which should shed more light on its debt reduction plans and latest NAV movements.

Wilmington (LON:WIL) - down 2% to 336p (£302m) - Interim Results [in line] - Paul - GREEN

I review H1 results, and come away happy with everything. I continue to see WIL as a good quality business, at a reasonable valuation.

Paul's Section:

Currys (LON:CURY)

Sky News reveals that this electrical retailer has had a £700m (c. 62p/share) takeover approach from Elliot Advisers. The Times went on to say CURY’s Board had rejected the approach as undervaluing the company.

Remember that CURY has a weak balance sheet, and a cash-hungry pension deficit. However, it has had a recent cash boost from the sale of its Greek subsidiary, and has remained modestly profitable despite the consumer squeeze in the last year or so. Maybe an acquirer is looking at potential profit upside from £9bn pa revenues? Only 1% extra gross margin is another £90m profit, after all. Perhaps I’ve been too negative on this one in the past? That said, a 62p offer is not very exciting upside - is it worth taking elevated risk, just for a 30% possible gain?

EDIT: Currys has confirmed it rejects the 62p offer in an RNS this morning, just out.

EDIT: The Times says Elliott is considering making another bid for CURY, and that the company is now in play, which might attract other bidders.

EDIT: I've just spotted that the Telegraph says Chinese giant JD.com is considering a bid for CURY, raising the prospect of a bidding war. Exciting!

62p seems unattractive when looking at the 5-year chart (bear in mind there has been no dilution too over this period) -

MicroSalt (LON:SALT)

114p (£49m) - Recent AIM float - Paul - AMBER

This recent (1 Feb 2024) AIM float cropped up in last Thursday’s SCVR, when I briefly mentioned it in the mid morning movers section, when it rose 24% to 105p on a US distribution deal. Readers continued the discussion in the comments.

It floated at only 43p on 1/2/2024, and has risen a remarkable 165% to date, at 114p (Friday’s close). This induced me to read the AIM Admission Document over the weekend, here are my notes -

MicroSalt (SALT).

Website: MicroSalt.co

Zeus float to AIM & NOMAD at 43p

Placing 2.15m shares, 5.16m subscription = 7.3m new shares at 43p = £3.1m gross proceeds to the company (£2.5m net of fees - seems very small, and I think the company will need to raise more funds quite soon, this is not enough, especially when all the additional costs of listing are accounted for, maybe £500k to £1.0m pa maybe?)

Important positive point - apparently no selling shareholders.

Important negative point - heavy dilution from warrants (7.3m, exercisable at 47.3p) and options (6.7m) - fully diluted share count could be 57.1m, 32% dilution (subject to conditions, see Admission Document for details).

First dealings 1 Feb 2024, so it’s now trading.

Florida-based company.

Only 7 employees, so it’s an IP company only - manufacturing is only on a trial basis, and is outsourced.

Founded in 2016 by Dr Clifford Gross, and TekCapital (listed: LON:TEK - could be worth considering as an investment into the controlling shareholder?)

What is the product? It’s salt, but made into tiny particles, thus giving twice the taste for the same weight of salt, unlike lower sodium alternatives which use other additives.

No history of sales or profits of any significance, but it claims to now have the first commercial scale orders.

Losing c.$2-3m pa.

TekCapital will own 77.2% after IPO (worth £38m vs TEK market cap of £30m - as of 16/2/2024)

Tiny free float.

Will need more cash, is my assessment of the numbers, beyond the modest IPO proceeds.

Very small historical Directors pay, so expect overheads to rise significantly post IPO.

Convertible Loan Notes of $1.8m from TEK at June 2023.

Key issues/questions -

IP protection - I could be wrong, but the company seems to hinge on just 1 patent in the USA. There are 14 more pending in other countries. The small print says the original founders (who sold the patent) get a 3% sales royalty until 2030 - which makes me want more clarity on when that key patent expires? All questions to ask.

Why float now, raising so little cash (£2.5m after fees)? If sales are about to take off, surely it would have made more sense to hold back, and float for a much higher valuation showing exponential sales growth? Looks a bit desperate to me.

Amazon reviews for MicroSalt - not many, suggesting direct to consumer sales have not yet taken off. One negative review says the very small particles mean that MicroSalt is powdery, like flour, and not usable as a day-to-day alternative to regular salt (resulting in an airborne cloud). So maybe that limits the market to B2B, eg for salted nuts, crisps (which are being trialled), etc.?

Paul’s opinion - this cannot be valued on any historic performance, as it’s only achieved negligible sales to date. So it’s a jam tomorrow situation, that may be amazing, or it might be a speculative frenzy. £50m market cap isn’t a vast amount for a good story in a bull market, I’ve seen large numbers of speculative micro caps go way higher than that, but hardly any reached commercial success.

Good luck to anyone having a punt on it, but personally I’d want a bit more track record and certainty as to whether this product is actually going to take off commercially, it’s too early to say at this stage.

So for me, it’s not of interest at this stage, but I’ll keep an eye on the newsflow. It’s a nice story though!

EDIT: I've just noticed an InvestorMeetCompany presentation from management is in the recorded archive, from 7 Feb 2024, so I might watch that later to hear the bull case.

Wilmington (LON:WIL)

Down 2% to 336p (£302m) - Interim Results [in line] - Paul - GREEN

Wilmington plc, (LSE: WIL, 'Wilmington' or 'the Group') the provider of data, information, education and training services in the global Governance, Risk and Compliance (GRC) markets, today announces its half year results for the six months ended 31 December 2023 (H1 FY24).

Wilmington plc is the recognised knowledge leader and partner of choice for data, information, education and training in the global Governance, Risk and Compliance (GRC) markets. Wilmington employs close to 1,000 people and sells to around 120 countries. Wilmington is listed on the main market of the London Stock Exchange.

I’ve got a favourable impression of Wilmington. Checking my previous notes, I reviewed the FY 6/2023 results here on 25/9/2024, concluding that I like everything about the company - growth, margins, cashflow, balance sheet with plenty of cash, and a reasonable valuation.

This is a first I think - a highlights table that actually gives me the numbers I want! (adj PBT & EPS) -

Clearly there’s been a significant disposal, as the statutory figures above show higher revenue & profit than the adjusted numbers.

I like these bits below from the highlights section, especially coming at a time when plenty of companies are telling us that some customers are retrenching -

…strong demand in Training & Education and Financial Services in Intelligence division

Recurring revenue from continuing businesses up 11%, underpinned by strong retention rates

Finance income has had a nice boost from higher interest rates, earning £927k in H1 (£297k H1 LY)

Note that EPS has increased less (12%) than adj PBT (23%), since companies are now having to absorb a significant hike in corporation tax (up from 19% to 25%), but that should already be in broker forecasts. Worth bearing in mind though, as it artificially suppresses EPS growth.

Outlook -

"We continue to actively manage our portfolio of businesses with one earnings enhancing acquisition and one disposal. We have also initiated a sale process for our Healthcare division, after a period of restructuring which put that business in a much stronger position.

"Our strategy is clear: to grow the business profitably across the rapidly expanding GRC landscape by a combination of acquisitions, which provide attractive returns on investment, and investing in our operations and infrastructure, as well as actively managing our portfolio in line with our required characteristics.

"Trading in the current financial year continues to be in line with expectations."

I can’t find any broker notes. The StockReport shows EPS of 22.5p (broker consensus) for FY 6/2024. Since H1 is 6.86p, then this implies a considerable H2 weighting to profits & EPS. I’ve just checked and that seems to be the normal seasonality, at least it was last year FY 6/2023 anyway (the pandemic distorts previous years). So all good I think.

Valuation - at 336p this gives us a FY 6/2024 PER of 14.9x, which seems reasonable for a nice quality business with a strong track record.

Balance sheet - NTAV is only £13m, but that’s fine because it’s a capital-light business model - there are hardly any fixed assets, and no inventories.

Cash is £23.9m, with no interest-bearing bank debt.

Cashflow - looks very simple. It generates plenty of cash, and uses it to make acquisitions, and pay divis. That’s pretty much it!

Paul’s opinion - it’s another thumbs up from me. This niche looks high margin, with plenty of recurring revenues, which tells me WIL is operating in a sweet spot, and clearly delivering services that clients value.

Shares seem reasonably priced still, and a 3.3% yield is worth having, when combined with a share price chart that has been trending up nicely since the pandemic lows, almost 3-bagging since then.

I can’t see anything wrong with WIL, so do leave a comment if you have a bearish view, in case I’ve missed something. It’s another GREEN from me.

Quite a lot of volatility in the past -

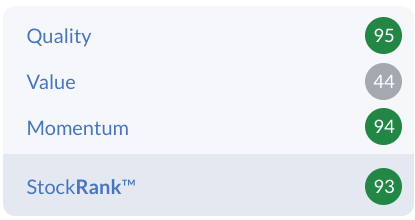

High StockRank reassures me -

Graham’s Section:

B.P. Marsh & Partners (LON:BPM)

Unch. at 466p (£173m) - Trading Update - Graham - GREEN

This investor in insurance businesses doesn’t tend to attract much commentary, but investors have seen a lovely return over the past few years:

We’ve covered it from time to time in the SCVR, e.g. in September, noting that the last-reported net asset value was c. 516.8p per share (fully diluted). The BPM share price at the time was 372p.

Today brings an update for the financial year ending January 2024.

Key points:

Three disposals for upfront cash of £93m (we already knew this).

Group funds rose to £40.5m as of January 2024.

“A robust pipeline of new investments”.

As we discussed before, the company has put a lot of thought into how to use the windfalls from the disposals made in 2023.

It recently announced the proposed doubling of its annual dividend, to £4m p.a., for each of the years 2024, 2025 and 2026. I think it’s quite rare to see a company signalling its dividends so far in advance!

Buybacks: £1m was spent on buybacks during 2023, and up to a further £6m will be spent on further buybacks.

It seems to me that BPM is probably getting the balance right: they are reinvesting most of the cash they’ve received from their disposals, but they are also providing a nice mix of dividends and buybacks for shareholders. It’s hard to argue against this, in my view.

Recent disposal: I haven’t commented on this before, but BPM’s most recent disposal - announced in December - was at a very nice premium to BPM’s valuation. This might help to provide us with even more confidence in the company’s NAV calculation. BPM is receiving nearly £42m for an investment it valued at £30.5m.

New investments: the new investments made in 2023 look quite small but are in line with BPM’s typical strategy of finding promising new insurance brokers / managing general agents.

Insurance market outlook:

The consolidation trend would seem to threaten BPM’s ability to find small independent companies worthy of investment, but BPM argues otherwise:

The ongoing consolidation trends in the Insurance Market show no indication of abating in 2024. Such activity remains a catalyst for substantial prospects for the Group, both in terms of new investments and activity within our core portfolio.

Both the Group and its portfolio companies continue to be approached by entrepreneurial individuals and teams who do not wish to be part of this consolidation process.

Graham’s view

I’ve been consistently positive on this one, and I’ll leave my stance unchanged here again today.

The share price has risen considerably but fully diluted NAV was last seen at 556p (July 2023) so the discount at the latest share price is still around 18%.

Given that recent disposals have been at or above BPM’s valuation of its investments, personally I’d have confidence in the NAV calculation here. Though it is inevitably a source of some uncertainty.

Brian Marsh (age 79) continues to hold 38% of the company that bears his name. I hope and expect that BPM will continue to apply its successful formula for many years to come, and that book value per share will continue to rise, even as the company makes larger dividend payments:

Springfield Properties (LON:SPR)

Share price: 77p (+1%)

Market cap: £91m

This Scottish housebuilder has issued a short announcement, re: the sale of land for £8.7m, most of which will be received in the current financial year.

As we discussed in December, this stock trades at a hefty discount to tangible book (£144m as of the last full-year results). However, one of the reasons for the discount may be some nervousness around the company’s financial position, including £68m of net debt.

However, the company laid out plans to reduce net debt to £55m by the end of the current financial year (FY May 2024), through land sales that would not affect its building plans.

That is the context in which we receive today’s update - with the proceeds from the disposal being earmarked for debt reduction.

CEO comment:

We are pleased to have agreed another profitable land sale, which brings the total since October 2023 to over £18m. With one of the largest, high-quality land banks in Scotland, these sales are an attractive way of monetising our land bank without impacting our development pipeline. We are in advanced negotiation regarding further land sales, which remains a key element of our strategy to reduce our bank debt."

Graham’s view

I’m going to remain positive on this one, as it seems the bull thesis is playing out as intended: the company has kept its debt position under control and is even reducing it, using its very strong balance sheet/asset backing to do so.

Springfield is not currently paying a dividend but it does offer a cheap multiple and future interest rate movements may be a help rather than a hindrance. So the outlook for shareholders seems quite positive to me. Interim results are due tomorrow, so we’ll find out more:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.