RESULTS

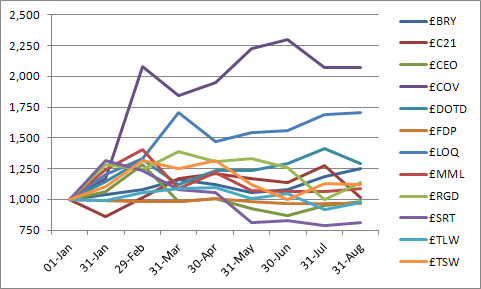

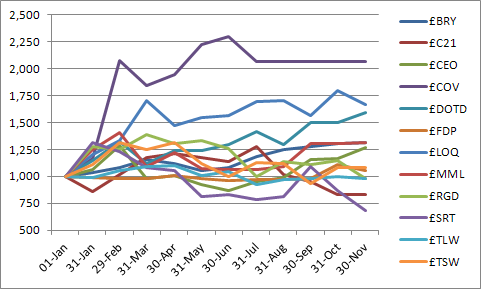

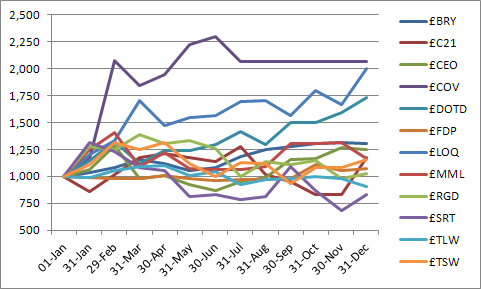

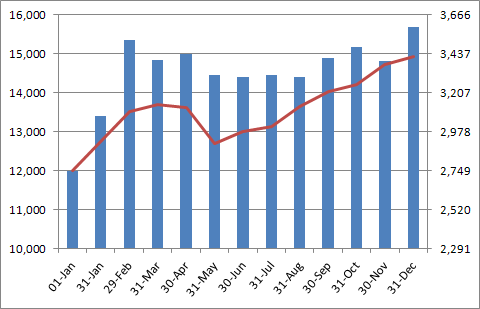

Portfolio value (start £12k) v FTSE SmallCap (start 2,749)

| Date | 01-Jan | 31-Dec | % change | Dividends | Yield |

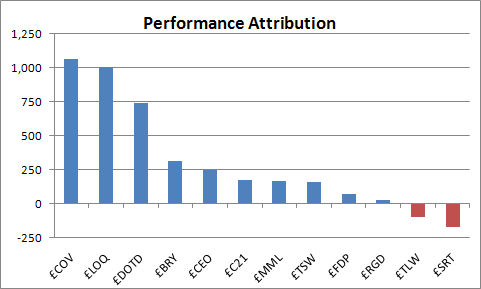

| Brady (LON:BRY) | 1,000 | 1,309 | 30.9% | 19.74 | 1.97% |

| £C21 | 1,000 | 1,172 | 17.2% | 241.38 | 24.14% |

| Coastal Energy Co (LON:CEO) | 1,000 | 1,244 | 24.4% | - | - |

| Cove Energy (LON:COV) | 1,000 | 2,065 | 106.5% | - | - |

| dotDigital (LON:DOTD) | 1,000 | 1,735 | 73.5% | - | - |

| First Derivatives (LON:FDP) | 1,000 | 1,069 | 6.9% | 16.80 | 1.68% |

| Lo-Q (LON:LOQ) | 1,000 | 2,005 | 100.5% | - | - |

| Medusa Mining (LON:MML) | 1,000 | 1,167 | 16.7% | 9.56 | 0.96% |

| Real Good Food (LON:RGD) | 1,000 | 1,024 | 2.4% | - | - |

| Software Radio Technology (LON:SRT) | 1,000 | 827 | -17.3% | - | - |

| Tullow Oil (LON:TLW) | 1,000 | 903 | -9.7% | 8.56 | 0.86% |

| Titan Europe (LON:TSW) | 1,000 | 1,160 | 16.0% | 0.27 | 0.03% |

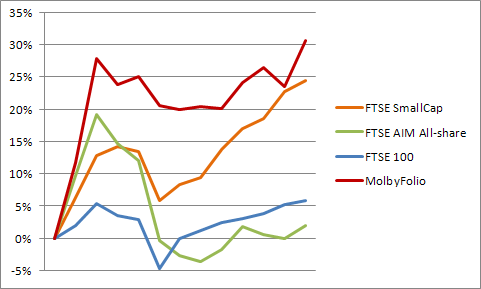

| Portfolio value (£) | 12,000 | 15,679 | 30.7% | 296.31 | 2.47% |

| FTSE 100 | 5,572.3 | 5,897.81 | 5.8% | ||

| FTSE SmallCap | 2,749.0 | 3,419 | 24.4% | ||

| FTSE AIM All-share | 693.2 | 707.21 | 2.0% |

PORTFOLIO BACKGROUND

*** PAGE HOLDER UNTIL COMPLETED *** (sorry, still not complete...)

Ever since I've had an interest in the stockmarket I find myself spending more time on portfoio allocation matters and performance recording at this time of year than any other. There's no logic for this time over, say, March or June, or even tax year-end, but the extended break allows for some reflection and setting some targets for the year ahead.

It's also the time of year when fun competitions abound to pick some winners for the year ahead (a ludicrously short time for investing) and newspapers publish share ideas instead of news, but I can't resist a comp so have submitted entries to a fair few that are found online*.

* Stockpicking comps:

Already have an account?

Unlock the rest of this article with a 14 day trial

Login here