It's that time of year when investors all tend to reflect on our relative performance to figure out whether we should throw up our hands and just invest in a (boring) tracker. And what a year it's been in the equity market! From the depths of despair in the early summer when the Euro crisis looked set to swallow us all... to the fiscal cliff relief relay of recent days. When all of that was said and done, in the year to January 3rd 2012*, the FTSE 100 gained 6.6% while the FTSE All Share was up 9.0%. As it's our mission to highlight what works when in the markets, let's take a look at how effectively Stockopedia's model portfolios of the Investing Masters have been performing versus these benchmarks.

Guru Models Keep On Slaying The Market....

The performance of the models this year has been frankly astounding. The screen performance can continually be tracked at this link or in detail here.

To recap, since December 15th 2011, we've been tracking 60 long only strategies and 5 short strategies, spanning from the investing greats (the likes of Graham) to classic academic finance papers (such as Piotroski). You can read more about how we run & rebalance the strategies here.

Of the long only strategies, an astonishing 90% (54/60) have beaten the FTSE 100 with gains of between 9% and 76%. Versus the FTSE All Share, 82% of the Strategies (49/60) are beating the Index. The average return of these long models was 22.4%.

On the short side, all but one of the short selling strategies are in negative territory (as they should be), and even that one, the Altman Z-Score screen, is well below the market return (having eked out just 0.22%). The worst (or rather best) performing short screen is down 24.4% in the last year, showing how important it is to avoid fundamentally weak, near bankrupt stocks with potentially dodgy earnings - no surprises there!

Which Strategies have done best?

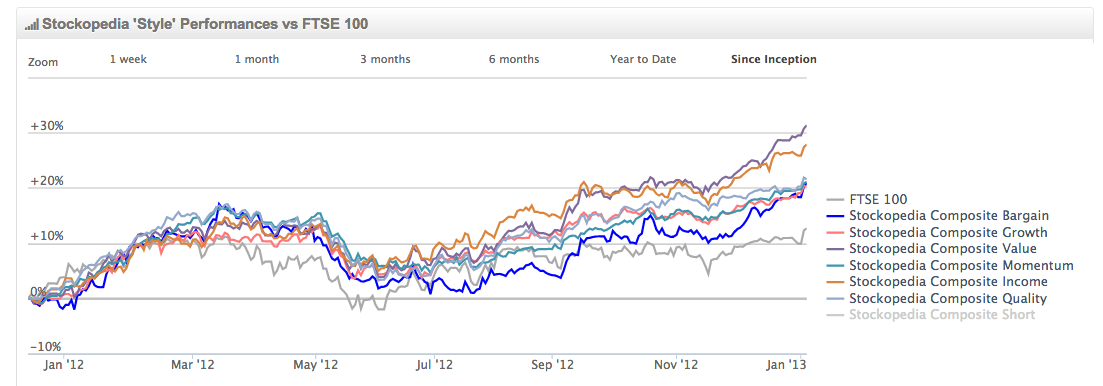

As you can see clearly from the following chart (continuously updated here), this year has been a story of Value and Income, which have outperformed other investiny styles.

At the top of the tables it's been a story of value, dividends and contrarianism trumping growth and…