It has been a dismal twelve months for investors in Blur Group, which has quickly become a poster child for heavily promoted story stocks that underperform. In just over a year its shares have slumped from a high of 780p to just 52p and its accounting credibility has come under fire. While some disappointments are unavoidable there are ways of shielding a portfolio from disaster stocks like this by using simple checks that highlight the biggest risks.

Does it have a low StockRank?

Over the past two years, a quarterly rebalanced portfolio of shares containing the bottom 10% of the market based on Stockopedia's StockRanks has lost 42%. The next two bottom deciles (with StockRanks between 10-20 and 20-30) each lost around 20%. By definition, these shares tend to have low financial quality, may be overvalued and have deteriorating price and earnings momentum. With a StockRank of 5 (out of 100) Blur has been in this bracket throughout the past year.

Over the past two years, a quarterly rebalanced portfolio of shares containing the bottom 10% of the market based on Stockopedia's StockRanks has lost 42%. The next two bottom deciles (with StockRanks between 10-20 and 20-30) each lost around 20%. By definition, these shares tend to have low financial quality, may be overvalued and have deteriorating price and earnings momentum. With a StockRank of 5 (out of 100) Blur has been in this bracket throughout the past year.

The very lowest ranking stocks tend to be small-cap mining and oil & gas companies, as well as speculative, unprofitable and often unproven businesses. One of the highest profile, consistently low ranking stocks over the past year has been mobile money company Monitise, which has seen its price fall by 75%. Among the current crop of stocks with ranks of less than 10 are software firm Cloudbuy and fuel oil developer Quadrise Fuels. Not all low ranking stocks will underform - and some will almost certainly recover. But on a portfolio basis, it could be worth checking that you aren't overexposed to too many low ranking shares, if any.

Is there a risk of bankruptcy?

Financial problems can occur for a variety of reasons but according to research, troubled companies often exhibit similar warning signs. Back in the late 1960s, US professor Edward Altman came up with a checklist of the most common balance sheet red flags. His five ratios became known as the Z-Score.

Financial problems can occur for a variety of reasons but according to research, troubled companies often exhibit similar warning signs. Back in the late 1960s, US professor Edward Altman came up with a checklist of the most common balance sheet red flags. His five ratios became known as the Z-Score.

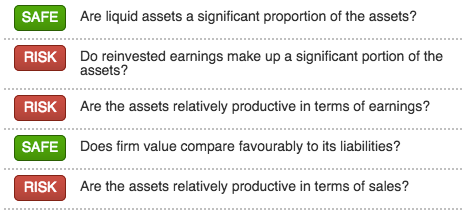

Altman found that bankrupt companies typically suffered from a history of declining levels of readily available cash and falling profitability. They also had relatively high levels of debt and were inefficient at generating profits from their assets. You can read more about it here.

Over the past…