As a former investment manager one of the funds I used to manage was the ‘Stewardship Income Fund’. This fund had 2 main criteria: it had to invest in ‘dark green’ ethical stocks and it had to achieve a level of dividend income well in excess of the market average to qualify as an income fund. The dual restrictions of the fund meant it was not permitted to invest in up to 70% of the FT All Share Index as measured by market capitalisation. Such a limited universe deterred many potential investors but the fund did well by adopting an unusual and pragmatic investment strategy that, I believe, could be appropriate for private investors.

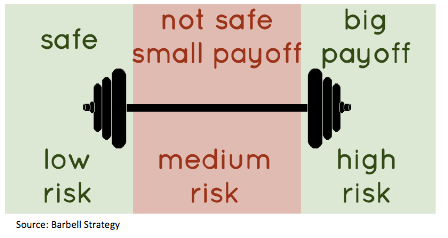

The approach the fund used was called the ‘Barbell Investment Strategy’. The strategy is more often used for bond portfolios by balancing holdings of long and short dated bonds. For stocks it is less common but is also used for portfolios to spread the risk between defensive, less risky holdings and more aggressive and speculative equities.

How the Barbell approach works

For the Stewardship Income fund the objective was to obtain the income of the fund from the safer/low risk end of the barbell (see chart below) which then allowed it to invest in stocks that paid below average or no yield but targeted capital growth at the other end of the barbell.

Typically, the income paying stocks were large, often FTSE 100 stocks, while the higher risk stocks were mainly smaller companies. With a portfolio that contrasted so much with the FT All Share Index it meant the performance of the fund was very different from the average fund or the index itself, in both directions! However, the returns compared well with other income funds, despite the restrictions, and interestingly it had a much lower beta than most other funds. This means that it was less volatile (or risky) as the barbell approach disseminated and, therefore, reduced the volatility of returns across the width of the barbell.

Meeting the needs of private investors

Since I have retired I have adopted this approach with my own investment portfolio. While not restricted in what assets or stocks I can invest in I, like the vast majority of private investors, have other constraints. Firstly, my limited savings mean that I cannot spread holdings across a large number of stocks, like an institutional fund, without making the holdings so…