It's always difficult looking back and trying to glean lessons for things in the future - the past is so inherently noisy that I wonder if many over-rationalise their losses and their wins. Any one investment has a plethora of movers, some of which one might not have identified, and in totality almost certainly one weighted wrong. That's not to do down on stockpicking, obviously - I'm a stock picker - there's just lots of company specific noise. I do think there's a danger in losing your money in, say, HMV, and concluding that stocks like Thornton's (I used this example after Thornton's rather spectacular rally) don't look attractive because they share some of the same characteristics. I sometimes get that impression, and I do feel it a little myself.

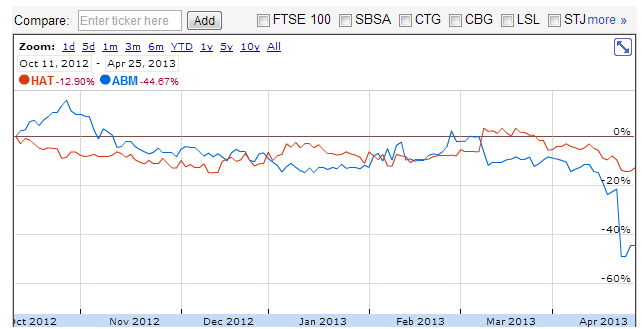

With that proviso; that I might be over-thinking it; I reckon I missed a trick on Albemarle & Bond Holdings (LON:ABM) and H & T (LON:HAT) . Both of these companies are pawnbrokers - indeed, both are very similar companies. The main difference, though, is the best type of difference for investors - they were trading at pretty divergent valuations last year. See the graph below, taken from Google Finance, which shows the price movement since the first of my posts:

Here's what I said then, almost a year ago:

I actually looked at Albermarle and Bond yesterday shortly after writing the post. The one overarching feeling I had when glancing over the annual report was one of the huge similarities between the two businesses. I’m not really sure how such a large valuation gap (ABM trades at almost twice the P/E) is justified. Broker forecasts probably explain the market ratings, since HAT is forecast for a significant drop-off in EPS next year and ABM is forecast to rise slightly.

Citing broker reports as a 'reason' for a difference in valuation is poor form, and I've tried to stop doing it since my young days. The problem is one of cyclicality - you'll see it time and time again where firms will have their forecasts raised after a price rally or cut after a drop, without any new material information. You might argue they know more than I do, and the rally is…

.png)