Bought Alternative Networks (LON:AN.) back in mid October 2013 after booking a 40% total return on Animalcare (LON:ANCR). This was done via a limit order after it drifted back post a positive trading update at the start of that month. It had come up on my screens and offered a decent yield, with the company stating later in their final results that they were going to grow it by 10% in 2014. It also had cash on the balance sheet of £17 million or so which was around 10% of the market capitalisation at the time which effectively lowers the valuation placed on the underlying business. They said they were looking for acquisition to utilize this cash.

Today they have announced an acquisition of Intercept IT Ltd for £12.95 million which they say they expect to be earnings enhancing in the first 12 months and beyond - not surprising given you get so little on your cash these days! At first glance it looks a high price, but they mention £5 million of contacted but unrecognised revenue, which if you factor that in makes the likely EV / sales versus the indicated margin look more reasonable. They also talk about "cost synergies" and this acquisition broadening their range so all seems sensible enough.

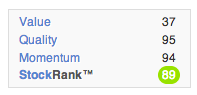

Again another one that has been re-rated quite nicely so not so cheap now on a headline prospective PE of 18.5x before any upgrades from this acquisition. The yield is still however a satisfactory 3.2% growing by at at least 10% although it is only covered 1.7x by earnings, but the cash flow is strong. On balance another I'm happy to hold for now, but may not be worth chasing at the moment.

UPDATE 24/1/14

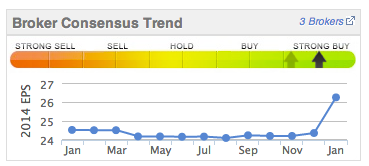

The shares had been strong and saw yesterday that they have done another earnings enhancing acquisition for cash - which is probably ideally what you want a company with decent returns and cash to do if they can find suitable opportunities. I see they have had around an 8% upgrade since the last time I wrote, presumably from factoring in the first acquisition. It looks like this one could lead to something similar but lets say 31p for 2015 to be conservative. That would leave it on 18.7x very similar to the…