It’s about that time of month when I can have a trawl of the Stockopedia rankings to see what looks interesting.

ALY (Laura Ashley) has a Stock Rank of 99, and has fallen 9.8% to 30p today. Paul Scott picks up the story (http://is.gd/X1JMZq):

at the time of writing, I hold a long position in this share … It has decided to spend £31.1m buying the freehold to an 8-storey, 98,254 sq.ft. office building in Singapore. This is to give the company a Far Eastern base, apparently. That’s a lot of office space, for a company which does 90% of its turnover in the UK! … property purchase seems bordering on the bizarre … Overall this company is one of my favourites at the moment

Paul is a much better investor than me, so bear in mind that anything I say here is pretty much worthless.

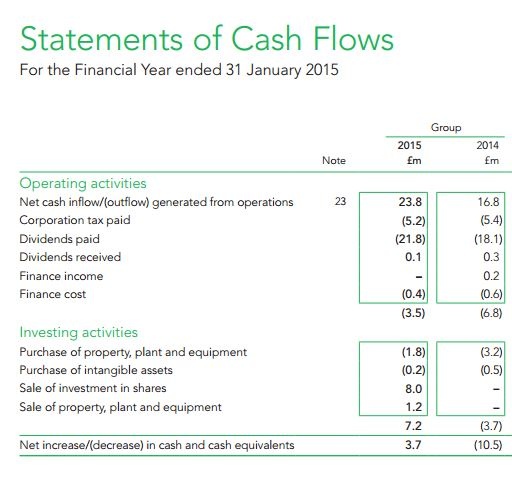

The company has a full listing (at least it’s got that going for it), and seems to be under the control of Asian directors. Dr. Khoo, a director of ALY is locked in a divorce battle. There was also the business recently of a shareholders meeting being held in Malaysia. Taking a look at the cashflow statements shown on Stockopedia, I see that the net income for y/e 30 Jan 2010 is £12.7m, rising to 23.8m for y/e 31 Jan 2015. However, the actual cash flow from operating activities has decreased from £11.9m to £-3.5m (negative). The cashflows seem to have declined progressively, too, although the year before was worse than the most recent report.

The Asian growth story seems exciting enough, but then it would, wouldn’t it? No doubt I’m wrong, but my gut instinct tells me to avoid this one. There’s too much intrigue. It’s all too bizarre for my liking. I’m not happy at all. It’s off my list, on the basis of “if in doubt, don’t invest”.

Let’s catch up in a year’s time and see how this one panned out.

May you all be well.

30p ASX 3585