With sales growing at 28% per annum (CAGR) in the last eight years, what could go wrong for AO World that is fast turning itself into an empire for selling electrical goods?

Sure, its 2014 IPO valuation of £1.2bn looks hefty to some investors, but sales grew from £80m in 2008 to £600m last year, and it would be a matter of time before profits reached a certain level that current valuation would make it look rather cheap!!

Instead of the share price shooting to the stars, investors have seen its value fell by 50% off to £1.40/share (its IPO price was £2.85/share).

So, where did it go wrong?

What is responsible for the share price miserable performance?

The answer to that lies in the lack of profits (or mounting losses made), high costs of setting shop in Europe and an overall “ridiculously” valuation as a whole.

So, what are causing the company not to perform to investors’ expectations?

Here are some things you need to know:

1. Lots of sales but lacking profit

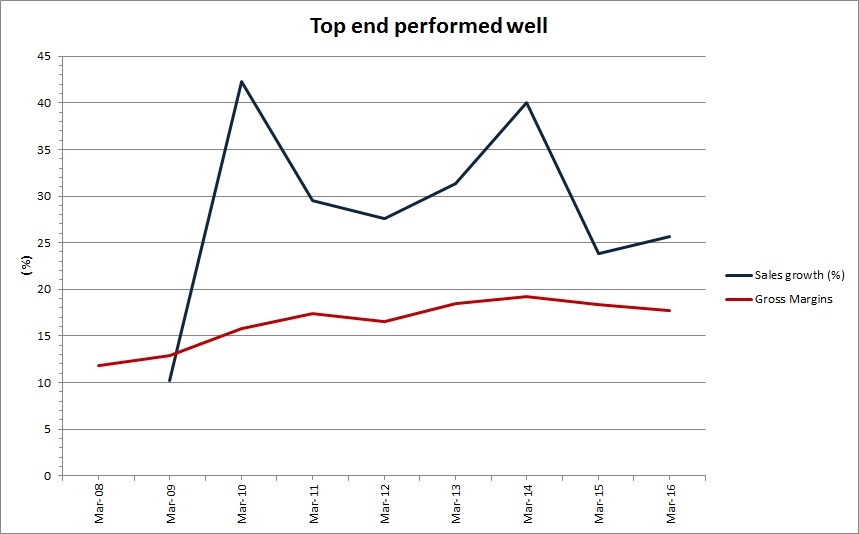

The

chart below shows the business is doing well.

Both

sales and its gross margins are steady and improving, but the “bottom line”

tells you a different story.

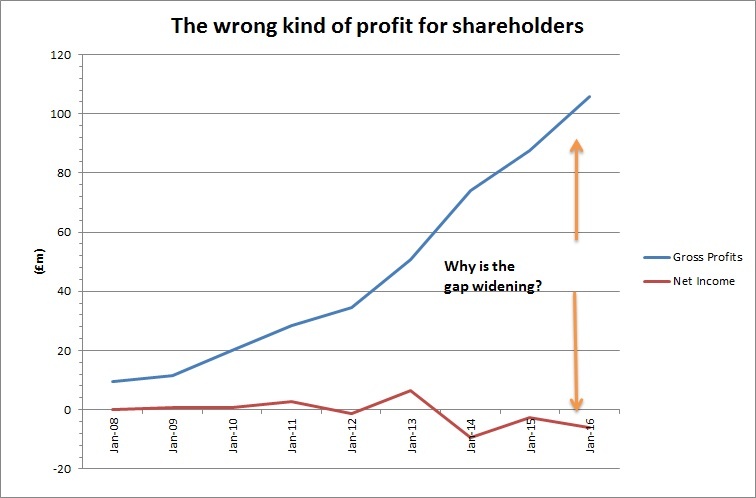

Look at the red line representing net profit it is negatively correlated with gross profits. In fact, in the last eight years, AO World made an average loss of £1m per year and currently reports a £6m loss in its latest fiscal year.

That should be alarming for shareholders because a company growing its sales, but not growing its profits means it is an uncompetitive business.

But management says the “margin squeeze” are down to the high-cost of setting shop in Europe.

Here is AO World European operational performance:

|

2016 |

2015 |

|

|

Sales (£m) |

40.7 |

5.9 |

|

Operating profits (£m) |

(23) |

(11) |

|

Adjusted EBITDA (£m) |

(21.1) |

(8) |

At the moment, we are giving management the benefit of the doubt. However,…