Introduction

The past decade saw 80 listings originated from China and over this period 45 companies have left the market leaving shareholders empty.

Back then, China was the engine of economic growth for the world economic and was growing four times faster than the UK.

Therefore, it made sense to invest in China because it equates to higher stock returns.

The UK investors had learned their lessons and stayed away from Chinese AIM businesses, even if it has a significant cash balance and orbital growth prospects, these financial results can't be trusted any longer!

They have stayed away!

You don’t need to talk to the fishes to know Aquatic Foods smell fishy

Despite a lack of interest from the UK investors, the Chinese did not shy away from the UK stock market, especially the AIM market. One of these companies, in particular, is called Aquatic Foods, which is today’s assignment.

So, a twenty minutes skim at Aquatic Foods statements and annual reports tell me several worrying things.

These are:

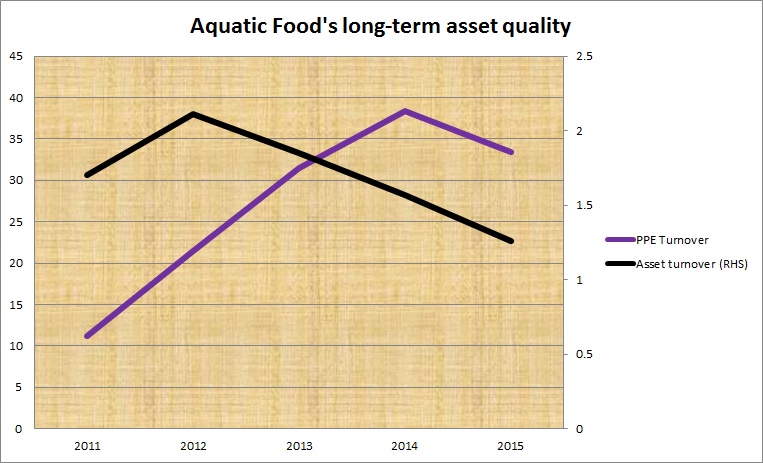

1. Strange asset turnover numbers

Source: Aquatic Foods annual reports (Graph reconstructed by the writer.)

Aquatic Foods monstrous sales growth didn’t stop its asset turnover from declining at an alarming rate since 2012.

On a separate measurement, Aquatic Foods grew sales by 354%. Therefore, measuring against Property, Plant, and Equipment (PPE) showed the opposite result it jumped by 400%, before declining slightly.

This led me to question how it was possible to triple sales, but not add additional capacity because the value of its PPE has stayed the same.

Unless fish prices jumped by 300% or Aquatic Foods were operating at a 20% capacity, I can’t see how this could happen!

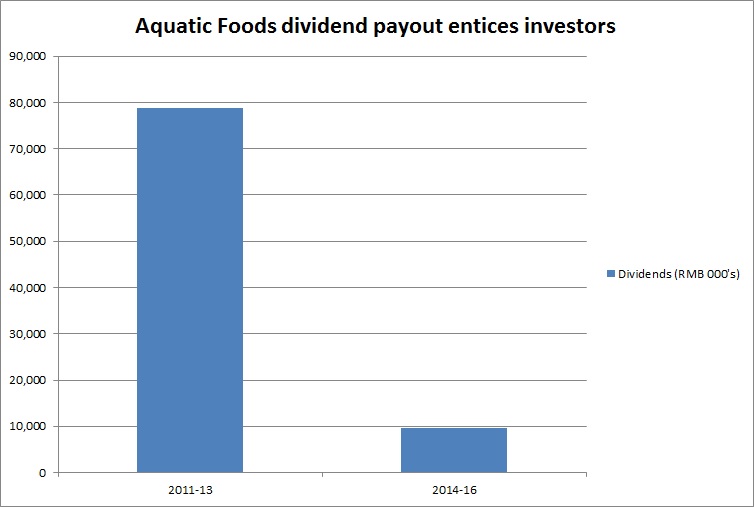

2. Dodgy dividend policies

If a business grew cash in the bank at a compounded rate of 46% per year in the last five years to £50m, but paid under a million pounds in dividends since its IPO, this raise a major red flag.

A

bigger alarm is Aquatic Foods paying a much larger dividend three years before

its IPO (See it for yourself):

Source: Aquatic Foods annual reports (Graph reconstructed by the writer.)

*2011-2013 dividends total £9m.

A normal…