Sometimes when I’m scouring the markets in search of a good place to put my money I’ll get a sense of déjà vu, a kind of, “hang on, I’ve been here before” moment. That’s exactly what I get when I look at the shares of Carillion PLC, the leading support services company.

Why should I get that déjà vu feeling? It’s because Carillion (LON:CLLN) looks uncannily like Interserve did when I bought it back in early 2011. To date my investment in Interserve has returned 114.5%, so finding another investment like that is obviously high on my list of priorities.

Carillion – An overview

The company operates in the Support Services sector which means it provides maintenance and facilities management for a wide variety of buildings, as well as financing, designing and building both property and infrastructure (including Public Private Partnership projects).

It’s valued at just over £1 billion, is listed on the FTSE 250 and generates about 75% of revenues from the UK (with the remainder coming from Canada and the Middle East and North Africa).

Past performance

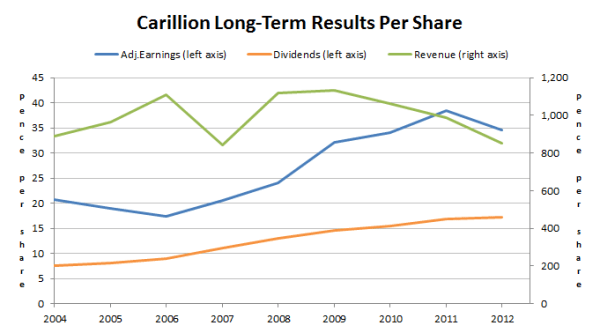

Starting with the past, here’s a chart showing how Carillion has done in recent years on a per-share basis.

There are two conflicting stories in this chart. The first is the relative stagnation in revenues, while the second is the near doubling of earnings and dividends.

If a company can double its earnings and dividends then of course that’s good, but there are limits to what can be done if revenues are not growing. After all, margins can only be expanded so far.

Why have revenues failed to grow for the best part of a decade? The financial crisis certainly doesn’t help. The UK construction industry is apparently still shrinking and as Carillion gets around 75% of revenues from the UK, that’s the main reason. However, the management have a plan to grow internationally, and personally I’m always more comfortable when a company has an international footprint.

The plan is to grow the Canadian and Middle East businesses to around £1 billion in revenues by 2015. That would leave the company with a more diverse revenue split, with around 60% coming from the UK and 40% from overseas.

From where things are today that will require a near doubling of revenues from overseas, so whether or not this goal…