Diploma PLC is a highly successful group of businesses operating in three distinct areas: Life sciences, seals and controls. What makes this FTSE 250 listed company interesting is its policy of boosting organic growth with carefully selected and nurtured acquisitions. In the past decade the company has grown rapidly, but can that continue, and are its shares worth their 700p price tag?

Background

Diploma began life in 1931 and moved onto its current acquisition-based strategy in 1969. However, as the decades passed the original acquisitions gradually went from growth, to maturity, and eventually into decline.

Around the turn of the millennium Diploma radically re-structured itself by selling off ten of its existing businesses. The resulting cash was then used to acquire a range of new businesses from internationally and industrially diverse backgrounds.

These businesses were successful and capable of further growth given the right investment and support.

This remains the company’s core strategy today; growing existing group businesses at ‘GDP plus’ rates, while boosting returns with new acquisitions that can benefit from being part of a group.

The businesses are run as separate business units in a decentralised fashion to enable them to react to their individual markets more effectively. At the same time they benefit from investment, systems, purchasing power, expertise and other features that the group can offer to each business.

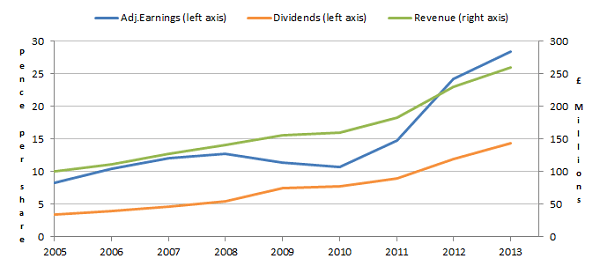

The chart below shows Diploma’s financial results for the past few years.

A very successful business

The average growth rate is a very impressive 15% per year. That’s way above the 4% a year that UK listed companies have achieved overall.

The growth is also impressively consistent, and is in fact more consistent than the results which underpin the FTSE 100.

The only downward blip is during the financial crisis, which is no great surprise. However it only affected earnings, while revenues and dividend payments have continued to march on to ever higher highs.

In many ways this is all part of the company’s strategy, which is to sell consumable products which are bought by their customers over and over again.

The website and annual reports make a point of stating that these products are typically paid out of their customers’ operational budgets rather than capital budgets. That means purchases are less affected by the ups and downs of the business cycle, and that’s exactly what shows up in the chart…