I was an earlier adopter of high StockRank based investing and I have done pretty well averaging over 25% pa over the past 4 years. Last July I decided to diversify and apply the same strategy in Australasian markets.

However, the results so far are not encouraging. I am down about 6% versus the ASX200, which is up about 10% and the NSX50, which is more or less unchanged. After a bit of fiddling, I have worked out that the basket of 90-plus Aus/NZ StockRanks in July 2016 has increased by about 6%. This suggests that I may have been a bit unlucky, but even with average luck I would have struggled track the indices.

Nine months is not long enough to draw firm conclusions, but I am starting to get impatient. There have been periods in the UK over the past four years where the strategy doesn't seem to do much, perhaps for about six months. But sooner or later there is a surge which takes overall returns to new heights.

From the performance charts here:

http://www.stockopedia.com/stockranks/performance/

... it is clear that High StockRank strategies have been working in the UK and European markets, but not really in the U.S. One possibility is that US markets are more efficient. However, I also wonder whether there are quite long periods when factor investing stops working in certain markets, perhaps even years.

I would be really interested in hear from subscribers in other regions about your experiences with using high StockRank based strategies (or any other type of factor based investing),

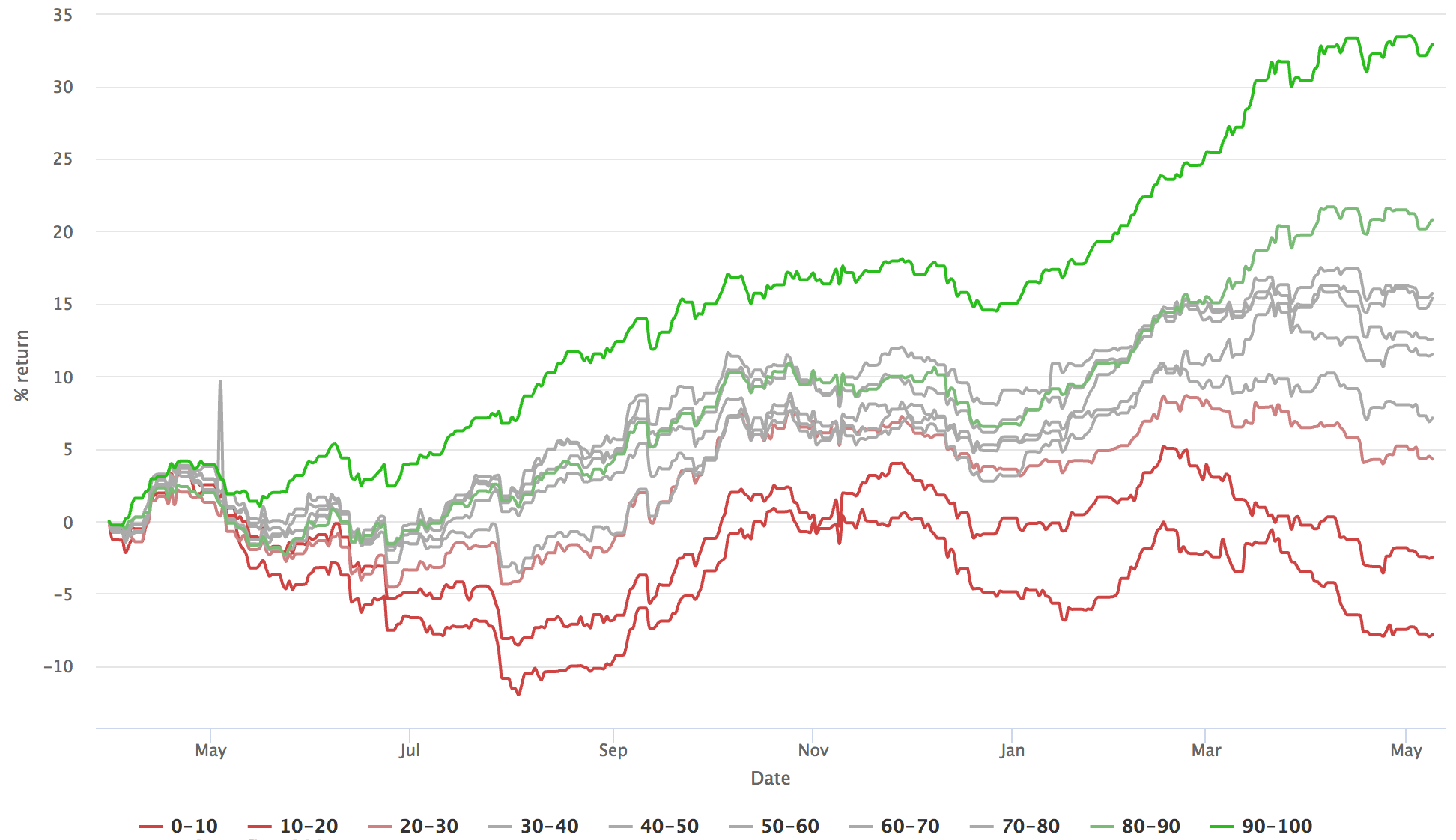

It's good to bring this up. We'll release all the new market performances soon enough - we launched these new markets on March 31st last year - so it's been about 13 months. Here's the actual chart from the Australian market... there's been some outperformance of the 20-30 bucket, but given the surge in Speculative shares in the last 12 months (and the fact that Australia has masses of miners) it's not a huge surprise that one low ranking bucket has outperformed. The 90-100 bucket has done over 20% in just over a year.

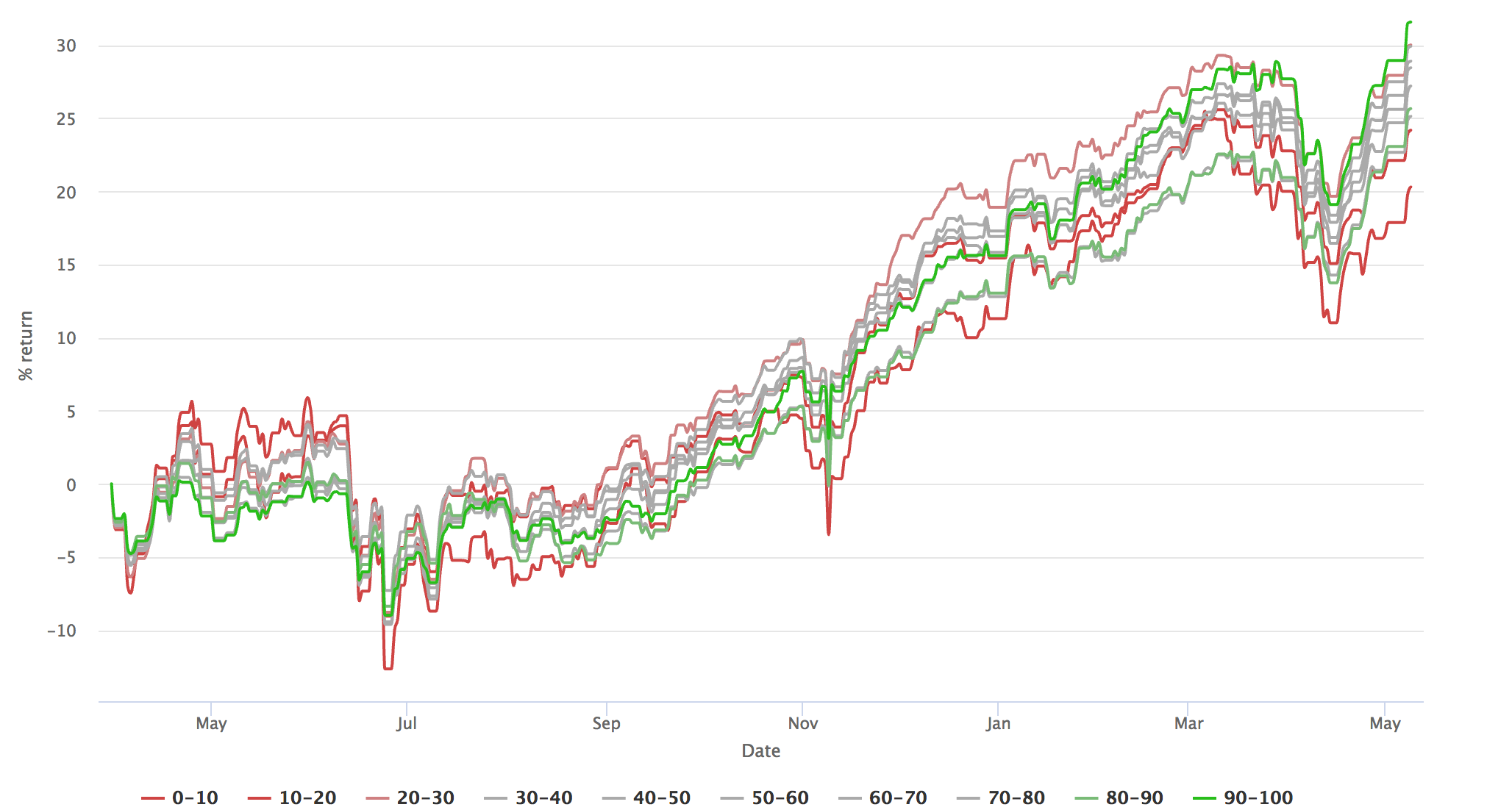

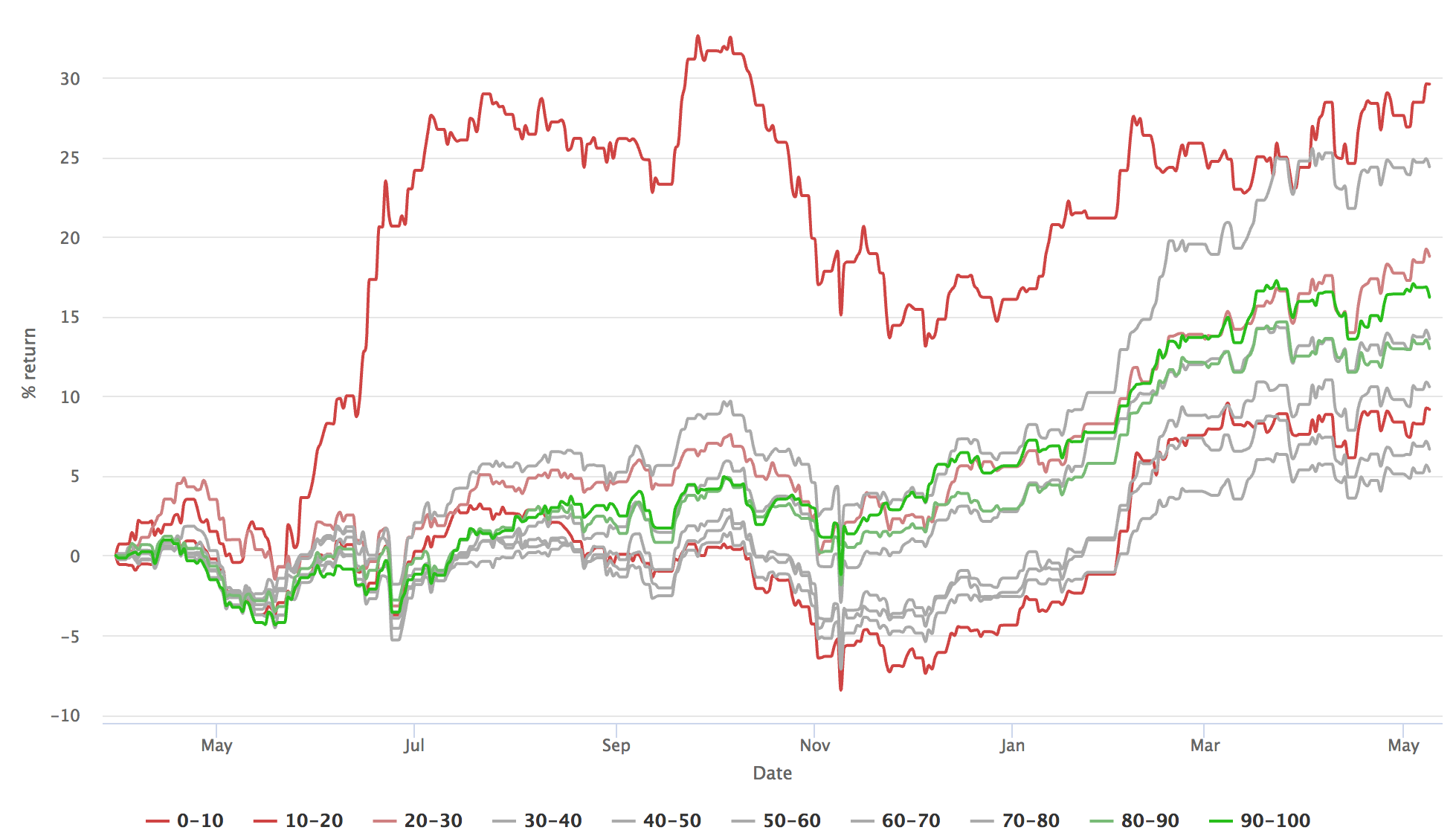

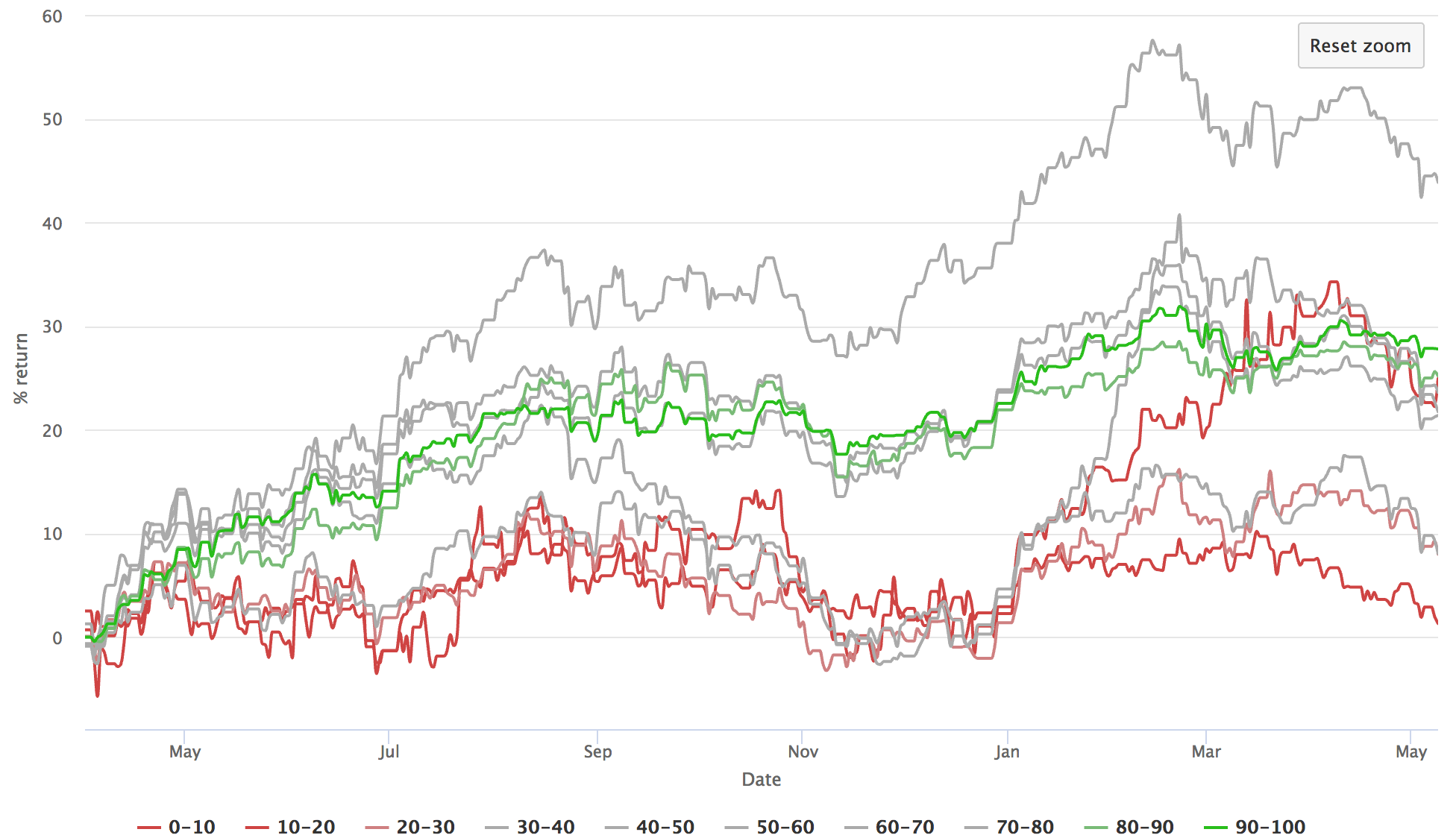

NB - all the following charts are quarterly rebalanced, £10m market cap+ with no transaction costs or dividends.

The Indian market has been astonishing though... The top decile is up over 80% in just over a year. The BSE100 itself is up 25% or more in this timeframe. The StockRanks have smashed it in India.

Hong Kong and Singapore taken together have returned 33% for the top decile and a very broad spread:

Japan has seen very little 'spread' between the deciles, but the 90-100 set is on top at about 31%.

Taiwan and Korea has a very noisy chart.

While in Canada, the 50-60 decile is on top followed by the 90+ set.

To be honest I find these results pretty re-assuring. In 3 out of 6 of these 'markets' the 90+ ranked set has outperformed on a 13 month basis. In 2 of the 6 it's been runner up and in another it's 4th.

While I don't have the global rank performance data, I would expect the spread to be pretty clear and remarkable.

Frankly I'm astonished by the results to date. I can't believe that these factor premiums are so pervasive in global markets. The reason the US sees so little spread between the top 3 quintiles I believe is because it's a super-efficient market with lots of quant hedge funds. We're working on our alpha there !