Mining companies or commodities businesses have made some big gains in 14 months. And these gains could come unstuck if China sees a slowdown.

The “Unsurprising” rebound of the mining sector

This chart shows the steady decline in the mining sector.

The FTSE Mining Index has fallen by 15% since hitting a two-and-a-half year high in February. Also, Goldman Sachs downgraded ratings for several mining companies, citing Beijing is tightening its monetary policy.

Below is a table showing the previous troughs in the mining

sector and its later recovery:

One reason for this weakness is the softening demand from China.

Is this a data blip, whereby China would continue pumping credit into its economy?

Or, could this be an end to the Chinese credit boom?

To answer in full, some unrelated topics on the mining sector needs covering but plays a big role in the demand for commodities.

Why China so important to mining businesses?

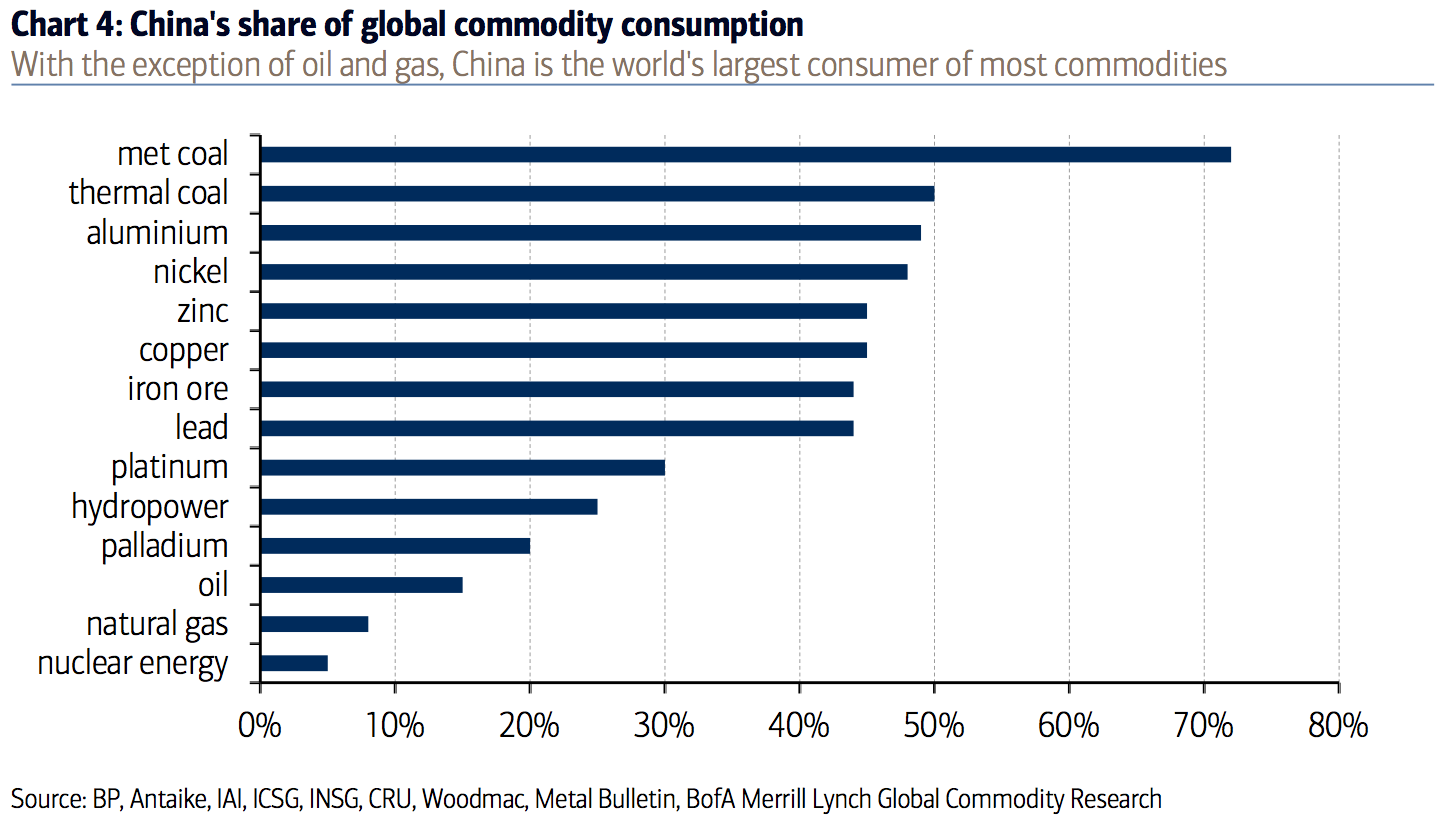

If you look at this chart, it is not surprising to see why:

For coal producers, their revenue stream is very much dependent on Chinese demand. Those who mine copper, zinc, nickel, iron ore and lead are also very exposed to any Chinese slowdown. Especially the major players (See table above).

The question investors should ask: “Why am I showing you this chart?”

Because China is going to experience another slowdown

The billion dollar question is when will this happen!

One of the biggest factors for natural resources is its huge

infrastructure projects. And the biggest is the Chinese Housing Market.

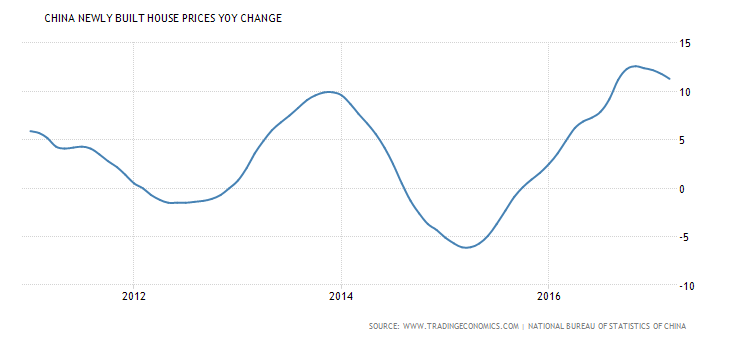

The last time China saw home price decline was two years ago.

And that fall of minus 5% sent commodities prices to collapse.

Since the summer of 2015, the rebound in China’s home price began. Prices started to turn positive in late 2015 and peaked in late 2016 to 13%. That saved the mining industry from a series of defaults.

Is the above chart signalling a decline?

We don’t know until you detail further evidence.

China Housing – in detail

On a month-on-month basis, you could suggest a rebound, pointing

to last month data!

Or, it could be a blip.

About their home prices, China is becoming more expensive. With prices at $171 per square foot, compared to the U.S.…