Everything seems to be going so well for Rolls-Royce (LON:RR.) So well in fact that, as you may have seen, the company recently had a royal visit to a factory in Singapore where another exceptional engine was unveiled to the world. However, although Rolls-Royce have done exceedingly well in the last decade, Rolls-Royce shares have done even better.

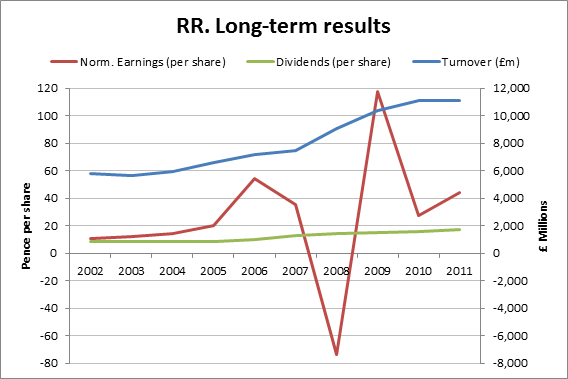

In the last decade, turnover has gone from £5.8 billion to £11.1 billion; profits have gone from around £200 million to over the £1 billion mark, and dividends have gone from 8p per share to more than 17p. Overall the company’s growth rate has been upwards of 10% a year, an exceptional figure for a FTSE 100 listed company whose market value is more than £15 billion.

You can see the results of this outstanding decade below:

You’ll have to ignore the manic earnings swing of 2008/9, which was currency related and didn’t show up in the adjusted, underlying EPS figures. The turnover and dividends show the underlying picture of steady growth much better.

In the last decade the company has roughly doubled its ability to generate sales, profits and cash dividends for investors; but that is literally nothing when compared to the returns from Rolls-Royce shares.

Unbelievable shareholder gains

In 2002 you could have picked them up for less than 200p each. If you were a really serious bargain hunter then you may have loaded up with Rolls-Royce shares at the incredible price of 69p in March 2003.

Since then the shares have risen to more than 800p, almost touching 900p a few weeks ago. That’s a gain of more than 300% in the last decade, even without taking dividend income into account.

If you had bought the shares for less than 80p at almost any time during March 2003, and then sold at more than 800p at any time since March this year, then you would have found the mystical “10-bagger”, and generated over 900% profit in only 9 years.

The more they rise, the further they have to fall?

I wrote about the bubble in defensive stocks recently, and I think that Rolls-Royce shares may be a prime example of this particular bubble.

The underlying company is definitely defensive. It’s large, global, robust, diversified and carries little debt. It’s a great global success story with a consistent ability to grow year…