Over the years, we have frequently stated that every that every major bull market will experience at least one back breaking correction. Usually, the correction culminates with a 50% pullback from the highs. In the case of Gold, this would equate to a pullback to $960. The precious metal’s sector had a splendid lope that began in 2003 and ended with a spectacular dash in 2011. To think that the Gold bull would continue unabated would be to put it mildly wishful thinking. Sadly, many Gold bugs opted for this line of thought, rather than dealing with reality; the reality being that it was time for the entire sector to let out some steam.

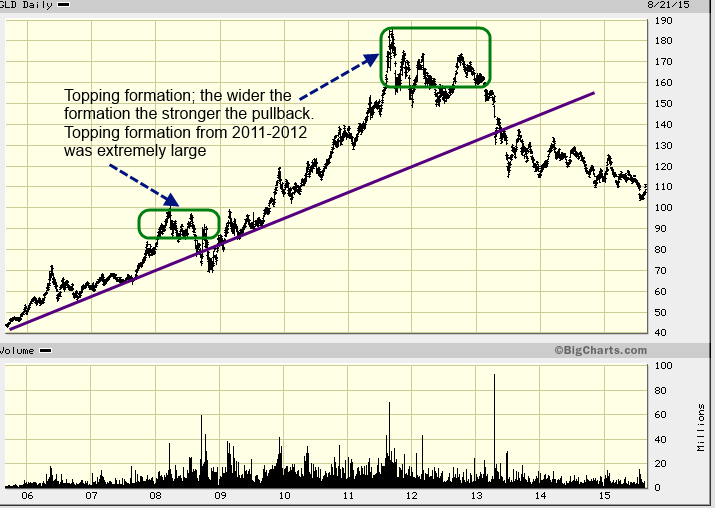

Gold bugs have a dangerous knack for losing contact with reality and embracing the illusory. When Gold topped out in 2011 and started to correct, they started to recite “the buy on the dip” mantra. When it appeared to have put in a bottom in the middle of 2012, they became Euphoric and start to hum “death to the dollar”. However, this euphoria should have faded when Gold refused to trade to new highs, and instead put in a series of lower highs (look at the chart below). A series of lower highs, after a very long run, is usually a negative omen. The Gold bugs were, however, unfazed and continued to sing “Kumbaya”, but alas no one was listening and the correction gathered steam.

We are using the ETF, GLD for illustrative purposes; it mimics the price of Gold fairly well. Note when a market is in a bullish phase, it does not put in a series of lower highs; this is a signal of exhaustion. This occurred twice over the past 10 years; the first incidence lasted from 2008 to 2009 and resulted in gold shedding 30% of its gains. The second time, the topping formation was much wider and gold from high to its current low hashed roughly 43%. History has a tendency to repeat and the repeat pattern (on a much wider scale) from 2008-2009, served notice to the astute investor that all was not well, and that it was time to bank some of those profits. We noticed these signals and the many negative divergences that our indicators were generating and advised our subscribers to close the majority of their precious metal positions in 2011.

From approximately…