Video Link:

IBTimes UK: FTSE 100 Hits All-Time Highs, So Buy Some Stock Exposure

Stock market indices worldwide have been crashing through key psychological levels to new all-time highs: 7,000 on the FTSE 100, 5,000 on the technology-heavy Nasdaq index in the US and 12,000 on the key DAX index in Germany.

But most people have missed out on this market rally

While this stock market rally sounds very glamorous, one of the key features of the current run-up in stock markets worldwide is how few people in Europe have actually taken advantage.

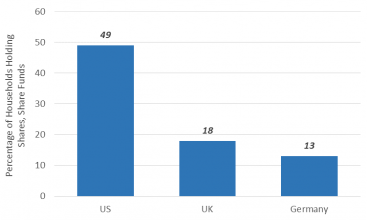

Figure 1: Only 18% of UK, 13% of German Households Have Exposure to Shares

Source: Office for National Statistics, US Federal Reserve, Deutsches Aktieninstitut

Take the example of the UK: only 18% of households hold exposure to shares directly or indirectly via unit trusts or other funds (Figure 1). That means 82% of households have seen no direct benefit from the doubling in value of the FTSE 100 index since the early 2009 crisis lows.

In fact, matters are even worse in Germany, where only 13% of all households had any exposure to shares or equity funds of any sort.

And you may think the doubling in value of the FTSE 100 over six years is impressive. Well think again. The German DAX index of Germany's largest 30 stocks has risen from 3,600 in early 2009 (a similar level to the FTSE back then) to over 12,000 today, more than tripling in value over the same six years.

The 2008-09 financial crisis took its toll on stock market confidence

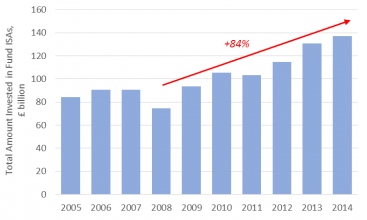

Clearly, the big hit to stock markets from the 2008 global financial crisis (when the FTSE 100 fell nearly 50%) has put many people off investing in stocks and shares, as we can see from the drop in value of unit trusts held in Isas from 2005 to 2008 (Figure 2).

Figure 2. Amount Invested in ISA-Based Funds 84%, When FTSE 100 100%

Source: Investment Association

Interestingly, the total value of funds held in Isas only rose 84% from the low in 2008 to the end of 2014, while the FTSE 100 doubled. Clearly, a lot of the money held in funds in Isas was not invested in shares but rather in other assets such as government bonds.

Yet again, more evidence that many investors…