Avation PLC

My thoughts here are based on my attendance at the Avation (LON:AVAP) presentation at Mello 2014 in Derby, some time talking to Richard Wolanski one on one at his stand afterwards, some further research subsequently and my long-standing interest in and knowledge of the aviation business.

Many had commented after his performance at Mello Brighton that they found Richard to be very bullish/promotional for an FD (by the way he's not a group director, so his FD title is just an internal management title), however I do find the Avation (LON:AVAP) proposition compelling (and if there's one business an accountant can get excited about, it's a numbers business like leasing!). Aircraft leasing in general is a good industry to be in, but not without risks. Although the global airline industry is occasionally subject to significant short term disruptions (9/11 and other terror-related incidents, SARS, Icelandic volcanoes, Ebola etc.), it keeps bouncing back. Global air traffic as measured in Revenue Passenger Kilometers (RPK's) roughly doubles every 15 years. Future demand as predicted by both Airbus and Boeing forecast this trend to continue.

Here are some of my thoughts and feelings on why this share could be worth looking at:

Favourable financials and valuation compared to peers:

Current P/E today is around 10 based on 2014 EPS and 8.5 based on 2015 Forecast EPS. That's a PEG ratio of 0.57. Note the figures on Stockopedia are slightly more favourable than this so I've recalced the actual numbers, although I did take the forecast 2015 EPS of 20p from Stockopedia.

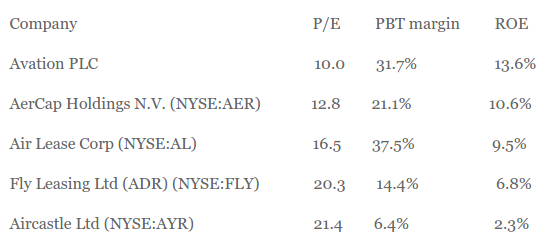

In the pack they presented at Mello they gave the examples of some competitors, mainly much larger US-listed players (two of whose tickers they got wrong!) so I had a quick look at the latest 10-Q's of those companies and looked at P/E, PBT margin and ROE respectively:

There appears no doubt that £AVAP's valuation is lower than its competitors, despite having favourable financial metrics. However Avation (LON:AVAP) is currently a much smaller niche player than its peers in this analysis.

Is there too much reliance on Virgin Australia/Sky West?

Currently they are somewhat exposed to Virgin Australia, specifically through the regional subsidiary Sky West which runs Western Australian regional routes using the ATR 72 aircraft. A key risk here is the continuation of…