I’ve written about Balfour Beatty (LON:BBY) before as a company with attractive income and growth characteristics. This global infrastructure business certainly does what I like to see a company doing, which is to grow consistently for years at a time. The latest set of half-year results show that this trend is not yet over, with revenues up 7%, adjusted earnings up 28% and the dividend up 6%.

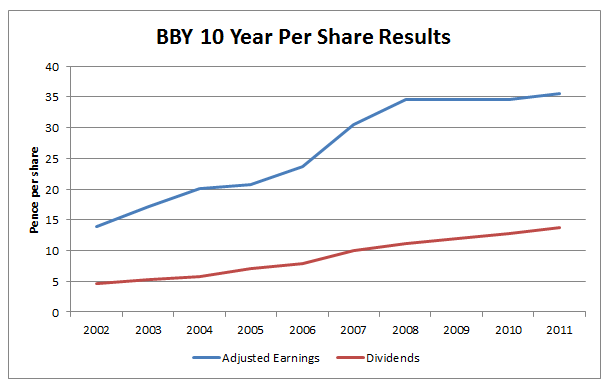

You can see what this looks like in the chart below.

The long-term growth rate has been something like 12% a year and the current dividend yield is just below 5%. Both of those are attractive figures, and especially so since the company has increased underlying earnings and dividends in all but one of those past ten years.

It is widely diversified across the globe and is, in my opinion, a strong business in an industry that is unlikely to disappear anytime soon.

Price and value

So let’s turn to the question or price, or more importantly, the value that an investor would receive at the current price.

Looking at price first, that is of course very easy. The price on the 17th of August 2012 at 1:09pm is 291.6p if you are buying and 291.4p if you are selling. That was easy, but unfortunately the question of value is not one that can be solved with so little effort.

I am a value investor and as such you might reasonably expect me to have some opinion on the ‘underlying’ value of Balfour Beatty, or to have some special means of calculating it. Sadly, neither is true. I think it would be entirely possible to come up with all manner of reasons as to why BBY should be trading at 200p and just as many reason why it should be more than 400p.

The fact is that investing is about the future and when it comes to equities, nobody really has the faintest idea what the future will bring. That is precisely why almost everybody fails to beat a blind and passive market tracking approach, and it’s also why the whole thing is so interesting in the first place.

This uncertainty is why I’m not a fan of ‘target’ prices. …