I took an accounting course a while ago, and partly for fun the professor described a forensic accounting technique, which I've been mulling over. In the spirit of Christmas, that time of year when we give away useless stuff to people we barely know, I thought I'd contribute the findings to the investing public.

You can read about Benford's law on wikipedia. The article there starts thus:

"Benford's law, also called the first-digit law, is an observation about the frequency distribution of leading digits in many real-life sets of numerical data. It states that in many naturally occurring collections of numbers, the leading significant digit is likely to be small.. For example, in sets which obey the law, the number 1 appears as the most significant digit [like 1.2, 0.015 or -178], about 30% of the time, while 9 appears as the most significant digit less than 5% of the time.."

The idea is that an accountant, wanting to cook the books to achieve some target result, jiggles numbers from one place to another and so disrupts the distribution of leading digits. The measure of suspiciousness is the discrepancy between the actual and the ideal distributions. That ideal, got from logarithm tables, is this sequence: 30.1%, 17.6%, 12.5%, 9.7%, 7.9%, 6.7%, 5.8%, 5.1%, 4.6%. Apparently the Enron fraud could be seen using this method - but it was only the company's final accounts which had been cooked sufficiently for the discrepancy to show up.

The explanation is exponential growth. If say £10 starts growing at 10%, it spends a quite while below £20, then starts to ramp up through the £20s, £30s, and flies past the £90s. It then spends a while growing through the £100s.

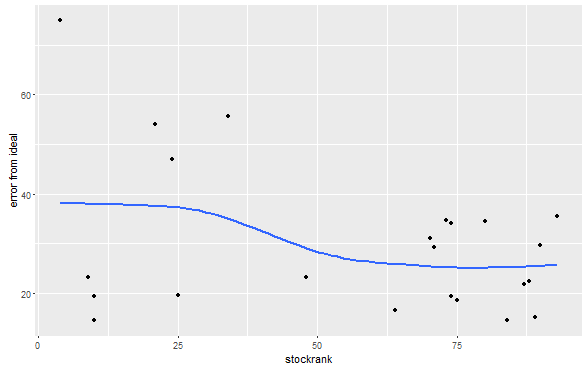

Does this work? Is, for instance, the error corollated with Stockrank? Heres a plot of stockranks against some Benford error scores:

So the answer is - not really. And even if more tests showed up a more robust connection, it could be for various reasons apart from fraud: an ex-growth company might show a bigger error. Also a company which is constantly changing its direction or restructuring. Steadily progressing firms might have a lower error, but this is just a proxy for Quality.

In any case there aren't enough numbers in the financial statements to give a good fit to the ideal numbers:…