Burberry (LON:BRBY) has had a pretty fantastic run of success over the past decade and so have its shares, with gains of more than 600% since the credit crunch.

That’s one of the most impressive rebounds I’ve seen since the dark days of 2009, but does that mean that the best gains for Burberry shares are behind us? Let’s try to find out.

First though, just to remind you, here are the four things that I’m looking for from an investment:

- High yield – Higher than the FTSE 100 or All-Share (i.e. the market)

- High growth – Faster dividend and share price growth than the market

- Low risk – Share prices that are less volatile than the market

- Low stress – Companies that produce more good news than bad, and those that can be more or less ignored for months on end without having to worry.

I’ll start off where I usually start, which is with the company’s financial history.

Good results that just keep getting better

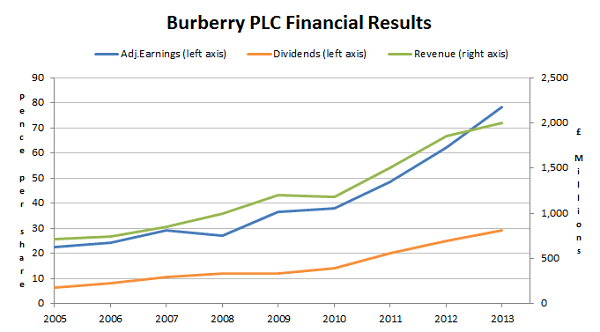

Can you see the financial crisis in the chart below? Other than the merest blip to earnings in the 2008 results and flat revenue growth in 2010, it’s barely noticeable. The rest of the time it’s been wave after wave of success for Burberry.

Here’s a quick run-down of the key numbers:

- Growth rate – Burberry managed to average a very impressive 17.1% a year, while the FTSE 100 has only managed to grow revenues, profits and dividends at 2.3% a year over the same time period.

- Growth quality – I like to measure the consistency with which revenues, profits and dividends have been made and grown. Burberry scores a very respectable 93%, while the pedestrian FTSE 100 scraps by with just 79% consistency.

- Debt ratio – My approach here is to compare the company’s total borrowings to a quantitative estimate of its average net profit through the next business cycle. Burberry looks good once again with borrowings around £130 million compared to estimated average future net profits of £335 million, giving a debt ratio of just 0.4. In most cases I consider a ratio of less than 5 as prudent.

Clearly Burberry has blown the large-cap competition away over the past decade. It’s growing fast, it’s growing consistently, and it…