Value and momentum are widely regarded as two of the most powerful factors that drive stock market returns. Cheap stocks tend to beat expensive stocks and, although it may sound counterintuitive, stocks which are rising in price tend to keep on going up. One curious exception noted by some analysts is that momentum may be less effective in Japanese markets. Cliff Asness of AQR Capital explains that ‘quite a few authors have pointed out that momentum is an empirical failure for stock selection in Japan’. Does this mean that investors in Japan can’t use momentum strategies to generate stronger returns? Let’s take a closer look by exploring whether investors could improve their performance by diversifying across a range of both value and momentum stocks.

Value in Japan

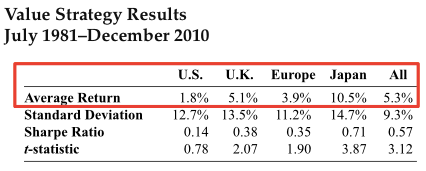

Buying shares that are priced below their ‘intrinsic value’ (or true worth) - otherwise known as value investing - is one of the oldest and most successful strategies in the stock market. Research by Cliff Asness suggests that value investing does pay off in Japan. He defined the value premium as the extent to which a basket of cheap price-to-book (P/B) stocks outperformed a basket of expensive P/B stocks. The value premium was calculated for stocks in the US, UK, Europe, Japan and a global region (ie. ‘All’). Asness concluded that ‘the Japan region turns in the strongest value results, even stronger than the more-diversified All region’. See here:

Some academics have attributed the value effect to investor overreaction. When investors hear good news they overreact and stocks become overvalued as the share price is driven too high. Conversely, when investors overreact to bad news, the share price is driven too low and companies become undervalued.

One argument put forward to explain why value strategies are so effective in Japan is that a larger proportion of the country's companies are cyclical. They include the likes of Nissan and Toyota. The overreaction effect is arguably stronger amongst cyclicals because the earnings of these stocks are more sensitive to trends in the business cycle. Indeed, profits tend to fall harder during an economic contraction. Investors could overreact to the first signs of a recession and oversell cyclicals, creating opportunities to buy Japanese companies at bargain prices. This is precisely the argument put forward by CLSA's Nicholas Smith in an interview with the John Authers of the Financial Times.