Anyone who has read our book "How to Make Money in Value Stocks" will be well primed in the idea that buying cheap stocks is a strategy that beats the market. This is hardly surprising. If you can buy productive assets on sale you ought to do no worse than even. What is surprising is the extent to which these stocks in general outperform.

Benjamin Graham once said that 'in the short run the market is a voting machine but in the long run it's a weighing machine' snappily illustrating one of the critical ideas for stock market success - that the market over-reacts but eventually corrects itself. But to pick up the extra profit that can be made by exploiting this corrective mechanism, investors have long debated what is meant by 'cheap'.

What is cheap? Different strokes for different folks?

Generalising grossly, most valuation is done by comparing a company's share price against either what it can earn or what it owns. Price/Earnings ratios, Price/Cashflow ratios, Dividend Yield, Earnings Yield, EV/EBITDA ratios etc all aim to judge price against what a company can earn, while Price/Book, Price/Tangible Book, Price/Net current assets, Price/Cash and so on all compare price against what it owns.

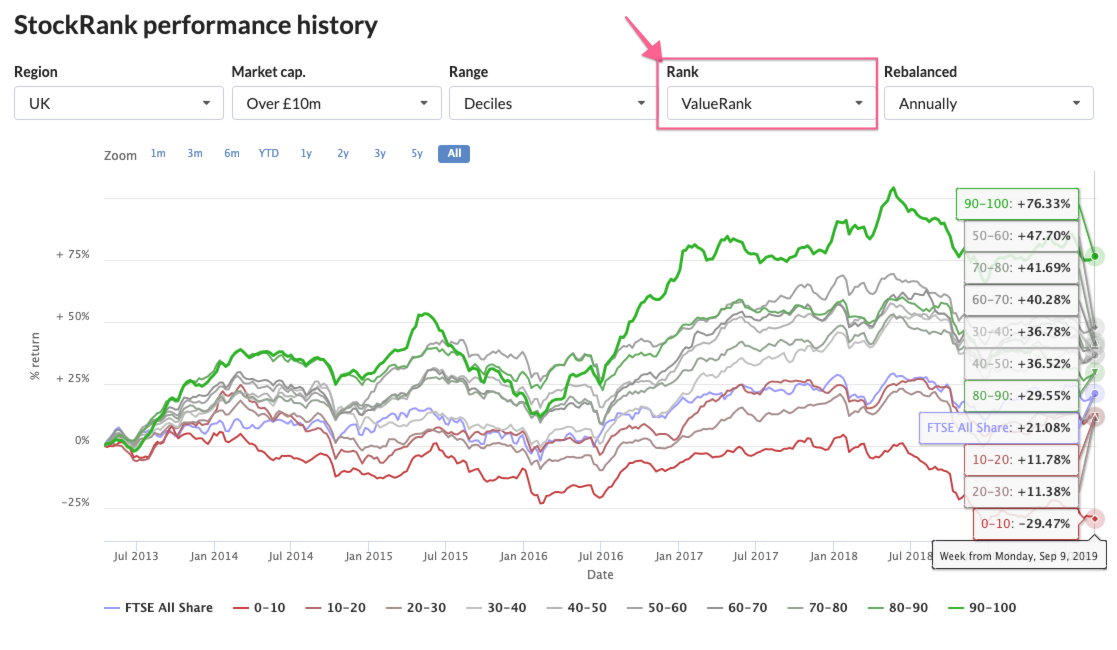

Investors are a hugely sectarian bunch and defend their preferred valuation metrics from all comers. But frankly, over the very long term there isn't that much difference in which ratio one prefers to use. The returns to ALL value ratios are highly correlated over the long run and have very similar return profiles.

What one does find though is that during different market cycles, different ratios enjoy their time in the sun. A brief glance at recent history shows that this is so:

- In the late nineties the Price to Sales ratio was most effective as dotcom companies failed to generate any earnings but flew to the moon.

- In the recoveries from most bear markets (2002+, 2009+ etc) the biggest bargains judged by asset based measures (P/B, P/C) often massively outperform.

- Between 2002-2007, EV/EBITDA based metrics were all the rage as the credit bubble grew and private equity sought to buy companies outright.

- In the current yield deprived times we live in, the dividend yield has been the most successful value metric as investors have thirsted for income.

All this begs the question as to how can one build a perennial strategy based on a single favoured ratio? If…