A hat-tip at the start again to red and Richard Beddard, who recommended Castings to me - explicitly by the former and implicitly by the latter having it in his portfolio for a rather long time now.

A hat-tip at the start again to red and Richard Beddard, who recommended Castings to me - explicitly by the former and implicitly by the latter having it in his portfolio for a rather long time now.

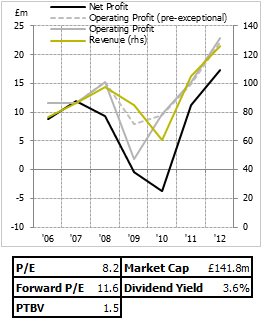

Castings (LON:CGS) are a manufacturing group, supplying iron castings and machining both to the UK and outside it - 66% of their revenue comes from aboard. I can't claim to know a great deal about the mechanics or the specifics of a business like this, but from what I can glean from the annual reports, it seems reasonably defensible and not as commoditised as I might have first thought. I get the impression the expertise and capital investment to get into an industry like this makes it different from other forms of manufacturing, which have seen their returns squeezed by relentless competition.

One of the more immediately obvious facts upon loading up their financial history is that this company, from a financial standpoint, is extremely safe. As of their last interim report, the group holds £14.6m (~10% of their market cap) in cash, with no debts - indeed, not even any liabilities aside from supplier payments and deferred tax. On top of that, the pension scheme the group runs is in surplus - the first scheme in surplus I've seen in the last few years - to the tune of £6.8m. This isn't with particularly generous/flattering assumptions in terms of future expected scheme earnings, either.

If that gives you an impression of a company that seems to have longevity and safety - perhaps, one must add, to the detriment of having a more efficient capital structure - at the forefront of its aspirations, I'd probably agree with you. Castings has invested heavily in the last few years after a blip in 2010, and their annual report and interim report suggests they have a good deal of spare capacity. Operating assets have fairly consistently risen, now sitting comfortably higher than they did pre-crisis. It seems as if Castings are well-placed if things pick up again.

That goes some way to explaining the recent drop in their share price with the half yearly report, then; it noted that that recovery is a little further off than we might had hoped, as the European truck manufacturers who make up…

.png)