International Business Times Video Link:

Edmund Shing: HSBC and Co-op Bank do battle as sub-1% mortgage wars break out

Could the first sub-1% mortgage rate be around the corner? Actually, it is already here. While the Co-op Bank recently launched a 1.09% two-year fixed-rate mortgage (which will move back to the standard variable rate (SVR) at the end of the term), HSBC has beaten this with an initial rate of 0.99% on its two-year discount special mortgage.

It is hardly surprising then that existing homeowners are thinking about remortgaging to lower their monthly mortgage payments. Surprisingly enough, the SVR on mortgages has actually risen since 2010 and now stands at 4.5%.

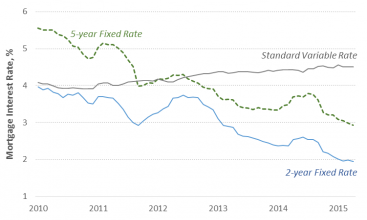

Figure 1. Two and five-year fixed mortgage rates still falling

Source: Bank of England

The average two-year fixed mortgage rate has fallen to under 2%, while the average five-year fixed rate is under 3% (Figure 1). And if you shop around, you can now find sub-2% five-year fixed rates too.

Nearly one in six homeowners are thinking about remortgaging over the next six months, according to a recent Nottingham Building Society survey.

They are hoping to save on average £99 per month, or nearly £1,200 per year. This is all thanks to the ongoing mortgage price war, driving rates ever lower. Let's face it, with the Bank of England base rate at a historic 0.5% low, interest rates are likely to only go one way in the long-term – up.

So remortgaging with a multi-year fixed rate will at least insulate the homeowner against the risk of higher rates for the foreseeable future.

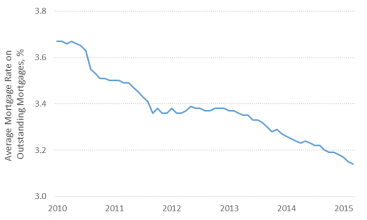

Average mortgage rate on outstanding mortgages

But how much is the average mortgage borrower paying at the moment? The Bank of England says "nearly 3.2%" (Figure 2).

Yes, this average rate has come down over the past five years, but it is still a long way from the current best two and five-year fixed and discount rates on offer today.

Figure 2. Average mortgage rate on outstanding mortgages still over 3%

Source: Bank of England

Let's say you are interested in remortgaging your house or flat. Where would you start and what should you watch out for?

Firstly, you can go the well-trodden route of checking out the online mortgage best buy tables at MoneySuperMarket.com, MoneySavingExpert.com or MoneyFacts.

Before…