Continuing with the manufacturing theme here, today I'm looking at an company ostensibly similar to Castings. Chamberlin (LON:CMH) is also in the business of castings and related machined products - credit has to go to them for making it easy to find relevant and interesting information about their business. I like it when companies cater to ignorant laymen like me, for instance by breaking down their revenue into end-markets; 30% passenger and commerical cars, 31% in construction, safety/security and hydraulics, and the rest in smaller markets like mining, power generation, oil & gas and so on. It gives me a quick and easy feel for the business, which appears to be more diversified than Castings with a wider spread of products and less stock in a few major customers.

Continuing with the manufacturing theme here, today I'm looking at an company ostensibly similar to Castings. Chamberlin (LON:CMH) is also in the business of castings and related machined products - credit has to go to them for making it easy to find relevant and interesting information about their business. I like it when companies cater to ignorant laymen like me, for instance by breaking down their revenue into end-markets; 30% passenger and commerical cars, 31% in construction, safety/security and hydraulics, and the rest in smaller markets like mining, power generation, oil & gas and so on. It gives me a quick and easy feel for the business, which appears to be more diversified than Castings with a wider spread of products and less stock in a few major customers.

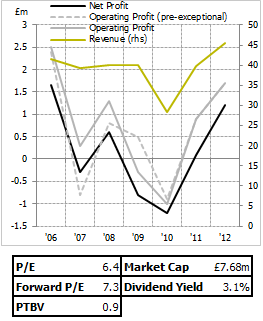

While what they do is a little similar to Castings in a broad sense, how they do it evidently isn't, as we quickly get to the cusp of the differences between the two companies: Castings and, it should be noted, Tricorn (another manufacturing company) interested me because of their stability of returns. The recession was noticable from their reports and their performance, but they continued to turn out operating profits. Outside of the recession, both of those companies earned good returns. Chamberlin's strength is less evident. Over the '07-'11 period in its totality the company lost money, and returns even before that were hardly spectacular - they were throwing off something like 8 and a half percent on their operating assets, with leases capitalised.

In a hoo-rah for market efficiency, you might say that's why Chamberlin is significantly cheaper than Castings. This is true. A question surrounding the relative valuations of the two, then, hinges on whether you think Castings's returns will get worse, or Chamberlin's will get better. It's notable that Chamberlin's share price has come down from ~190p in October 2012 - about double the current price. At the risk of succumbing to a generous helping of hindsight bias (everything's obvious when it's already happened!), I think that price substantially overvalues the company as it stands.

Here's the problem - we're presented with a company which has, over the last 10 years, made £9.7m in operating profits. My adjusted, after-tax operating profit figure sits at £7.7m for that time period. Given…

.png)