The Kingfisher Fortnightly Bulletin suggests that the hour is almost upon us for the upcoming appraisal well at Cladhan. See the following extract from page 3 regarding Transocean's semisubmersible J W McLean rig. You know it's getting close when they tell the fishermen about the rig position...

Drilling Operations – Transocean JW McLean – Cladhan 210/29a-4 (New Entry 29-06-2010)

Drilling Rig/Ship Start Date Finish Date Installation Name/ Well No Position

Transocean JW McLean 07-07-2010 30-09-2010 Cladhan – 210/29a 61°08.987'N 000°47.116'E

Please note, this does not mean that the rig arrived on the 7th, as the Kingfisher works on a date range notification. The 7th is only flagged up as the earliest possible arrival of the rig. By way of background, Encore Oil (LON:EO.) has a 16.6% interest in the block and it is operated by Sterling Resources, which has a 39.9% interest. You can see details of the block and the discovery well here. Comments and thoughts below are welcome.

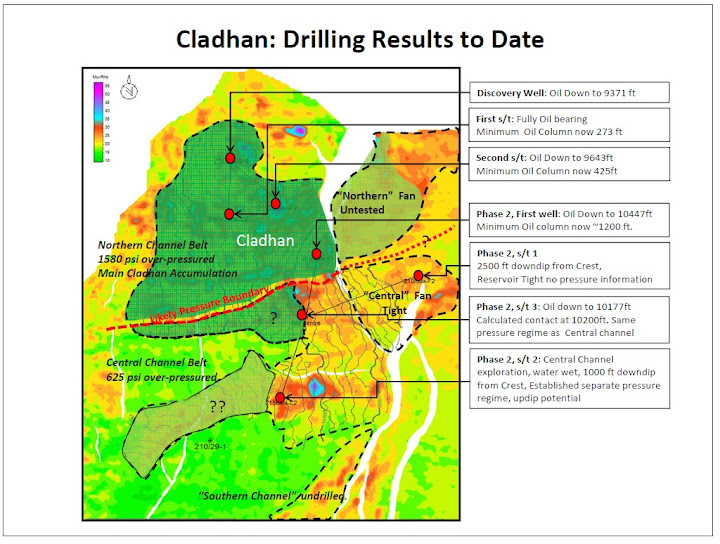

The 210-29a-4 well was drilled on the Cladhan prospect (formerly known as 'Bowstring East'), in October 2008 and was successful with the result of a light oil discovery... The partnership group took the decision not to carry out a well testing programme in late 2008 and the well was suspended with a view to re-entering and undertaking sidetracking, coring and testing operations at a future date, following integration of the well results into the seismic model. An appraisal well is due to commence drilling between late May and early July 2010 to appraise the potential extension to the original discovery and refine the range of volumes, using the J.W.MacLean semi-submersible rig.

Disclosure: The Author holds share in Encore Oil (LON:EO.)

.JPG)