Clarkson is the world’s largest shipbroker and has benefited from the long-term growth in seaborne trade. The company dates back 163 years and has survived the many downturns seen in the shipping industry. The recent acquisition of RS Platou and improving charter rates provide a positive backdrop.

Global trade has grown at a faster rate than economic growth as the global economy becomes more integrated. Shipping facilitates over 90% of global trade and has therefore seen strong long-term expansion.

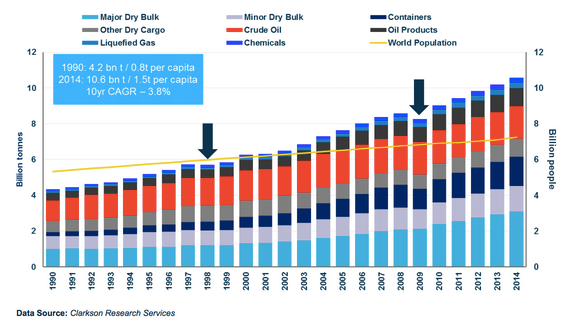

In 2014 the volume of goods transported per person (per capita) by sea weighed 1.44 tonnes. This compares to 0.8 tonnes in 1990 and comes on the back of rising incomes per capita with strong growth in emerging markets.

A second driver has been population growth with the global population rising from 5bn in 1990 to 7bn in 2014. Putting these two drivers together and shipping volumes have increased by 150% from 1990 to 2014, which is around 4% a year.

Shipping volumes from 1990 to 2014

Source: Clarkson investor presentation

A sector that offers long-term growth can be a good place for investors to evaluate. This isn’t necessarily the case, though, with the airline industry consistently failing to generate a return above its cost of capital.

In the shipping industry the key area of volatility is the charter rates for hiring out ships. The time taken to build ships means that there can be a bulge in deliveries in this midst of a downturn which depresses charter rates.

There are a number of ways to get exposure to shipping which include ship owners, shipbrokers, port owners and service companies. Ship owners have direct exposure to ship charter rates as it determines their income.

Many ship owners appear to have had flawed business models with high levels of debt providing little room for error. Certainly the long-term share price performance of the ship owners Dryships and Goldenport isn’t impressive.

Many of the ship owners have their origins in Greece and as such the moral appears to be: beware of Greeks bearing ships. Turning to shipbrokers and by not owning ships much of the industry’s risk is mitigated.

Clarkson is the world’s largest shipbroker and has recovered well from the shipping downturn. The group purchased Norwegian shipbroker and finance group RS Platou in February 2015, which has strengthened its market leadership.