MONDAY

British Land

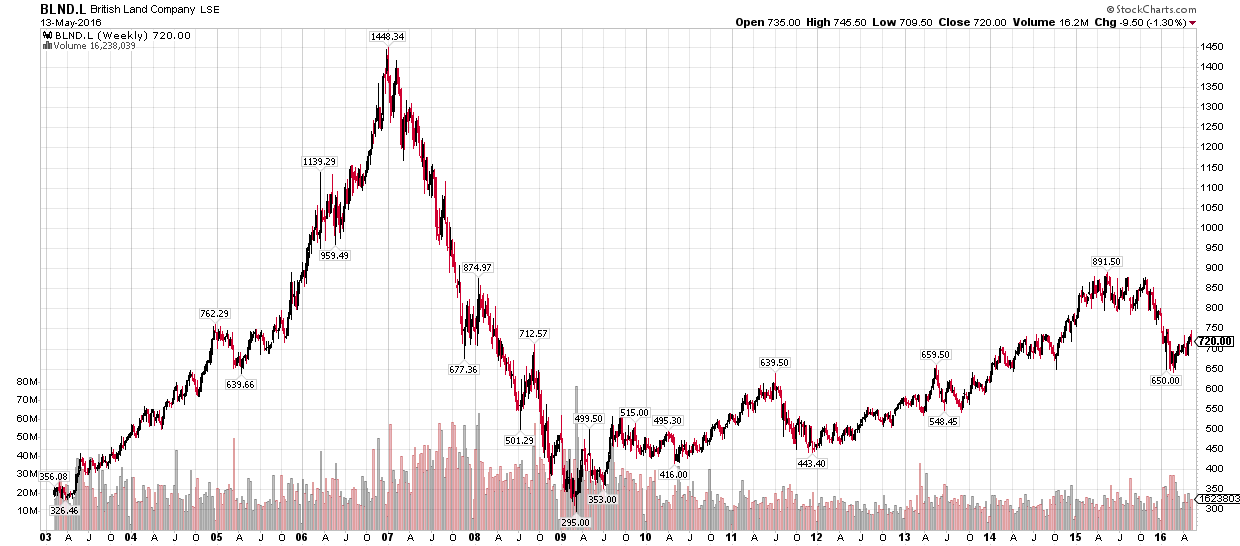

The owner of commercial and retail properties has seen its shares dipped from £9/share to £7.2/share in less than a year because “Bricks and mortar” retailers are struggling against its online counterparts.

With interest rates at record lows, renting out properties is still a very profitable business. Here a remainder of its stock performance since 2003:

Source: Stockcharts.com.

(N.B.: For a clearer picture, click here.)

These are some bullish points about British Land:

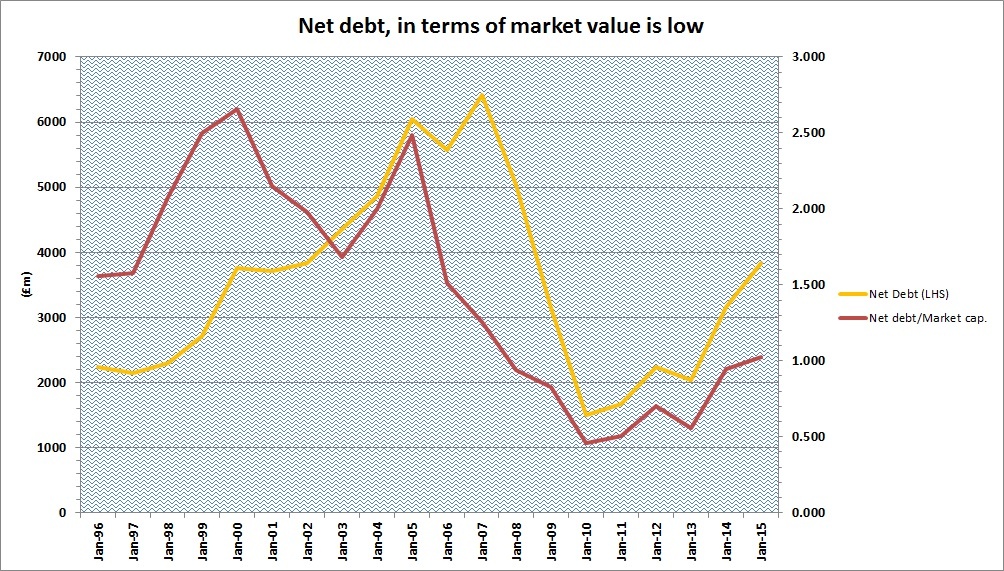

1. Debt deleveraging

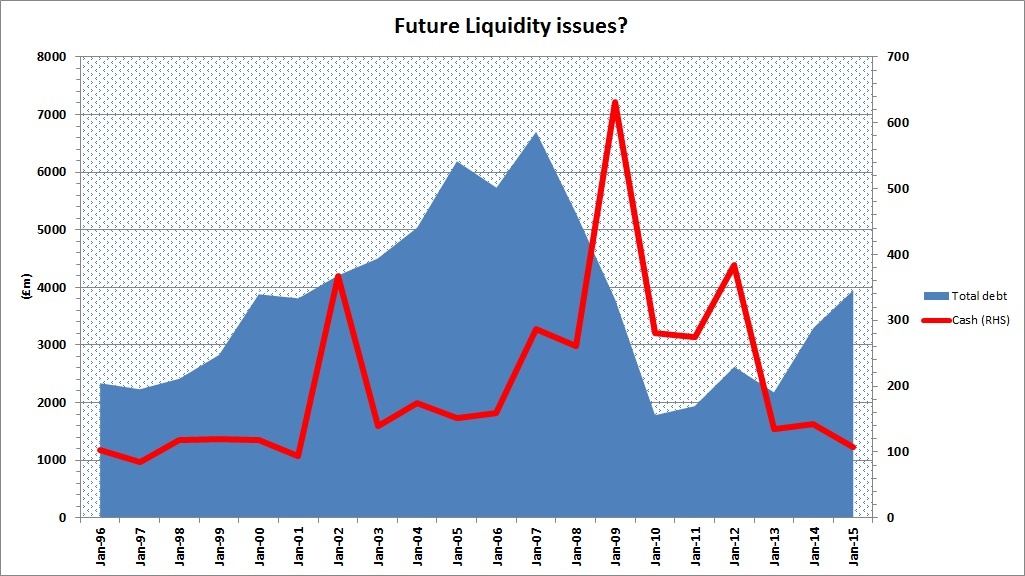

Source: British Land’s annual reports.

The company has deleveraged “dramatically” with net debt falling from £5.8bn in 2006 to £1.6bn by 2010 (80% change from peak). It helps to lower its “net debt/market cap.” ratio to record levels.

As property prices recover, it’s not surprising that British Land has re-leverage its balance sheet to take advantage of lower interest rates.

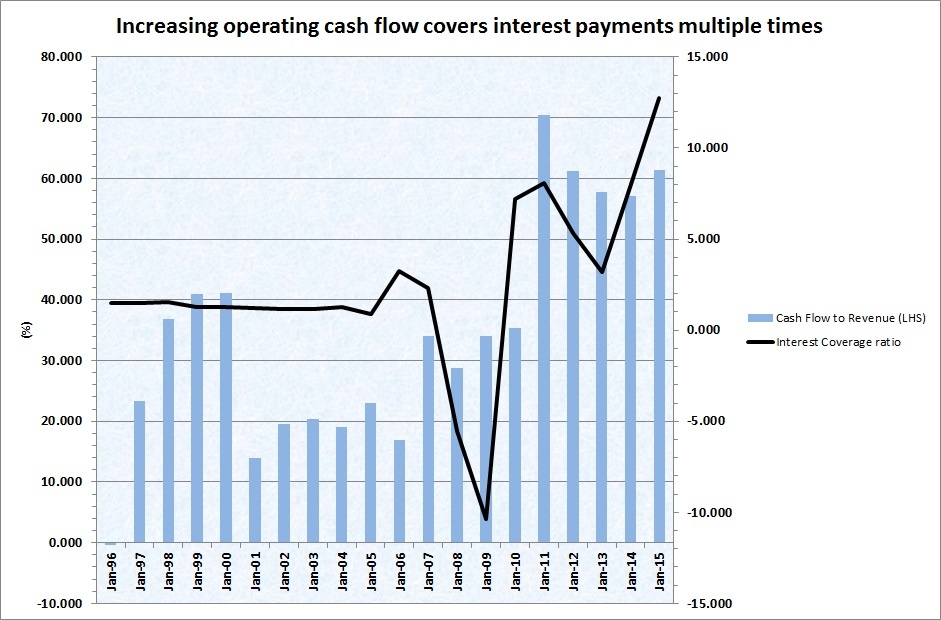

2. Strong cash generation still covers interest payments

Source: British Land’s annual reports.

Operating cash flow margins are around 60% and above, up from the 20% level. Interest coverage is covered 10 times over, up from the norm of 2%.

However, low-interest rates are a sign that the UK economy is feeble meaning returns are low.

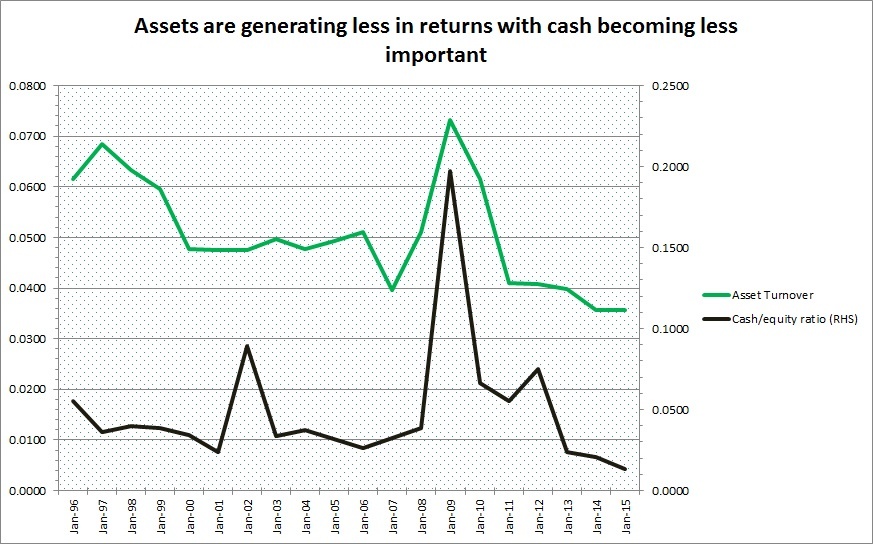

1. Low asset return

Source: British Land’s annual reports.

The cash “component” is playing a less important on the asset side of the balance sheet as it accounts for 1.3% of the company’s equity (it has historically average 4.8% in the last 20 years). Moreover, revenue is still 30% below its peak, since the GFC.

But, this did not stop the company re-valuing its properties portfolio, resulting in low asset turnover.

2. Debt growth is back

Source: British Land’s annual reports.

Earlier, I mentioned the low levels of cash against equity. With the cash balance of £108m, this is the lowest cash position since 2001. But more interestingly, the debt to cash ratio now is at 36 times, a level not seen since 2001 and 2006 (both of which follows a share price decline).

Investors should be aware of this last important point.

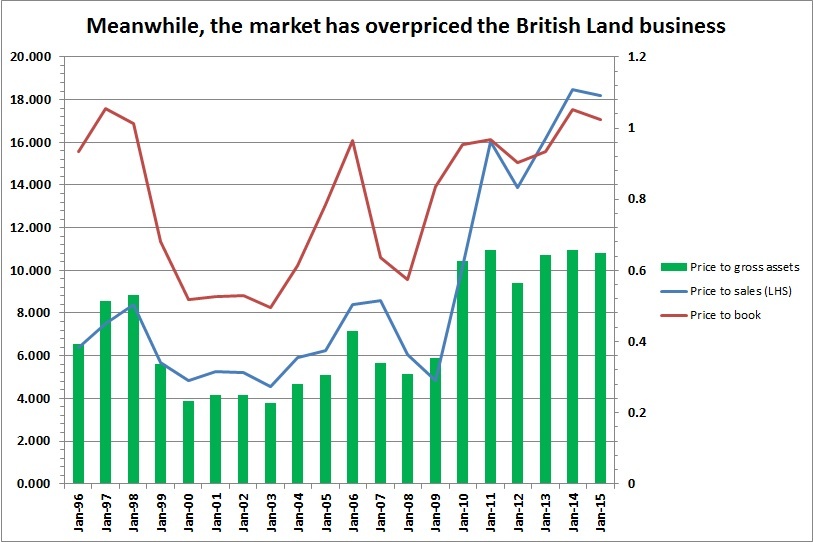

3. Markets have fully priced in British Land

Source: British Land’s annual reports.

As seen in the title, the markets have fully priced in British Land business.

Regarding book value, sales or its gross assets, British…