Anyone scanning Alpha International (LON:ALPH) ’s 21 March FY 2023 headline results could be forgiven for thinking that they’d had an OK year:

- Group revenue increased 12% to £110.4m (2022: £98.3m)

- FX Risk Management revenue increased 10% to £76.3m (2022: £69.5m)

- Alternative Banking revenue1 increased 18% to £33.9m (2022: £28.8m)

- Underlying2 profit before tax grew 11% to £43.0m (FY 2022: £38.6m)

- Consistent underlying profit margins of 38% (FY 2022: 39%)

Pretty respectable, but these headline bullet figures exclude a substantial new line of income - Interest Income on Client Funds. This has grown significantly in 2023 – add that back in – and you get a very different picture such that the Profit Before Tax at £115.9m is greater than their, as presented, reported revenue of £110.4m?!?

So alternatively you could present their results....

‘ALPH's business model provides a natural hedge such that when the economic environment dampens fee income, higher interest rates drive interest income; boosting profits and cash generation.

Group total income rose 73%, with FX Risk Management revenue up 10% to £76.3m, Alternative Banking up 18% to £33.9m but primarily driven by Interest Income up 685% to £73m. Accordingly, reported Profit before tax increased 148% to £115.9m and Basic EPS was up 124% to 206.2p. Net cash increased by £64m up 56% to £178.8m (2022: £114.4m).

So, in fact they shot the lights-out!

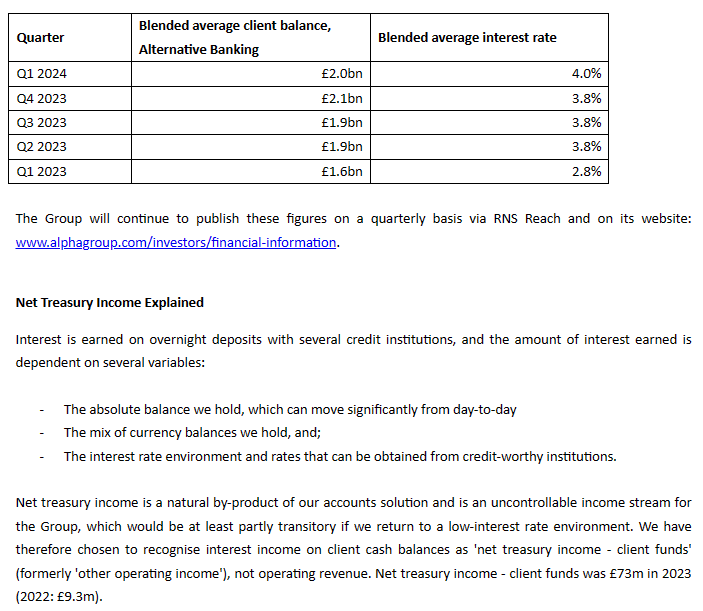

Whilst this windfall will clearly reduce with the interest rate cycle it will have generated significant cash to enhance the value of the business. Also, it is unlikely that we'll see a return to ultra-low interest rates and with cash balances growing along with client numbers - it'll continue to be a significant part of the income mix going forward.’

Nevertheless, you’d expect the valuation to temper your enthusiasm and indeed yes Stockopedia has Alpha International (LON:ALPH) on a PE Ratio (f) of 23. Until you realise that the Brokers’ Analysts have also contrived in this fiction, and they have also excluded the interest income from their forecasts.

Alpha International (LON:ALPH) FY23 basic eps 206.2p was x3 the Brokers consensus forecast for FY23 (68p).

Hence with the Brokers consensus eps forecast for FY24 of 78p and FY25 of 90p suggests that we're currently trading on a forward p/e of…