Real estate investor Daejan Holdings saw a record improvement in its Net Asset Value in the year to March 2015. The net revaluation gain came in at £229.7m and helped push the NAV per share up by 20% to £81.84. With the company family controlled the share price stands at around a 20% discount to NAV.

Daejan’s 2015 Annual Report makes for impressive reading with another year of solid NAV and dividend growth. The refurbishment of Africa House in London provided a boost along with a successful rent review at The Strand Palace Hotel.

The property assets in the USA also saw a tailwind given the strength of the dollar against sterling. As such 2015 was a vintage year and going forward rental and valuation gains are likely to be more in-line with market trends.

The Strand Palace Hotel in London

Source: Daejan Holdings annual report

Daejan Holdings has a strong long-term track record with its dividend not having been cut since 1993. This is in part due to having low gearing with borrowing over assets at 16.4% at March 2015 versus 17.6% at March 2014.

Source: Daejan Holdings 2015 annual report

The Freshwater family owns just under 80% of the shares and two Freshwater’s, Benzion and Solomon lead the company. These are the sons of Osias Freshwater who started Daejan Holdings after moving to London from Poland in 1939.

Two of the next generation of the Freshwater family have joined the board as non-executive directors. However, they are both pursuing careers in other fields and so it is not clear if the family management of the group will continue.

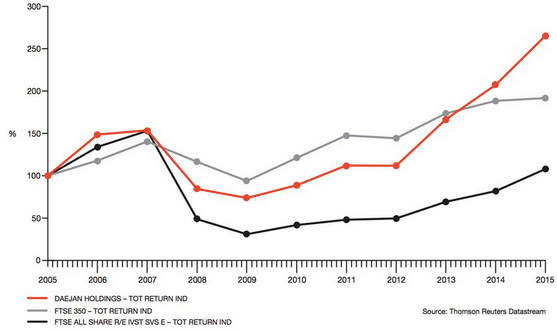

Family ownership and the illiquidity of the shares appears to be responsible for the circa 20% share price discount to net asset value. However, the structure has also delivered strong long-term performance for investors.

Daejan’s strategy and asset base

Daejan’s objective is: “the long-term, low risk growth in net asset value and in prudently our rental income and dividends.” The strategy to achieve this is three pronged with the first part being the management of assets to maximize rents.

The second part is to identify value enhancing development opportunities within the existing portfolio. Lastly, the group seeks out new property acquisitions that have the potential to enhance the long-term asset value.

Daeajn had 77.5%…