This private equity investment company which last reported a trading update on the 4th of August, has recently been written about by IC's Simon Thompson [ST] (edition 12/08/16) flagging it as significantly undervalued. He first tipped it at 146.5p and it has since seen a 11% decline in share price but he still sticks to his convictions.

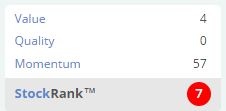

Due to the nature of the business/lack of data it doesn't seem to be able to be ranked by Stockopedia, receiving a StockRank of 0.

ST's case can be boiled down to a few major points,

The portfolio's performance over the year - 12p-15p improvement in portfolio's NAV in the first 6 months of the year from 200p, [13p uplift due to sterling's weakness]. This NAV of 212p-215p compares to a closing share price on 11/08/16 of 127.5p.

Prior Performance - 33% return on investment in prior year

Investment in Time Out (LON:TMO)- This is a significant part of OCL's portfolio (24% on float date). It was admitted to AIM in mid June at a price of 150p which gave it a market cap of £195M. £OCL 's holding was valued at £91.7M. The value of this investment had fallen by £13.2M on 30th June when the NAV was recorded, which represented a 7p per share reduction. However the share price has recovered somewhat with a 9% increase since 30th June representing a value of 44.7p vs. 41p which uplifts NAV to a range of 215.7p-218.7p (Ceteris Paribus).

ST then goes on to subtract cash and interest receivables which are valued at 58p from the NAV (equates to 159.2p) and share price (equates to 69.9p) which means the shares are trading at a 56% discount to the private equity portfolio.

My first issue with this view is that Time Out (LON:TMO) looks on first glance quite a poor investment. Below is the SR for Time Out (LON:TMO).

The balance sheet is a car crash with a D/E ratio of 1.383 and 77% of the company's' assets are intangibles and goodwill (majority). If it was generating a good…