Over the past two years Stockopedia’s scoring and ranking of every company in the market has turned up some inspiring results. Shares with the greatest exposure to the key factors of Quality, Value and Momentum have performed very well on average. In fact, a quarterly rebalanced portfolio of the strongest 10% of stocks has delivered a return in excess of 70%. This is plainly an eye-catching performance for any investor focused on capital gains. But for those with a preference for dividend income, the question remains - can StockRanks be used to find dependable high yields too?

Why dividends matter

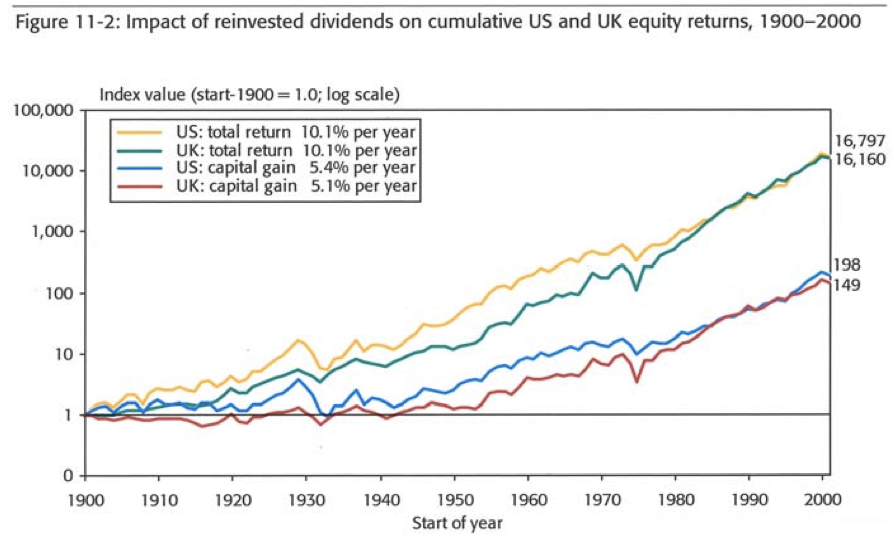

The impact of dividends on long term ‘total’ portfolio returns’ is well documented. One of the most comprehensive studies was published in a 2002 book called Triumph of the Optimists by UK academics Elroy Dimson, Paul Marsh and Mike Staunton. They showed that while year-to-year investment performance is driven by capital gains, the lion’s share of long-term performance actually comes from reinvested dividends. Their research showed that over 100 years, an investment in the market portfolio with dividends reinvested would have produced 85 times the wealth generated by the same portfolio that only relied on capital gains.

What StockRanks say about dividends

For those new to the concept, each of Stockopedia’s Quality, Value and Momentum Ranks is built using a composite of ratios and data points for each company. However, the only dividend-specific ratio in use across the ranks is the Dividend Yield. This is one of the six measures used in the ValueRank. In this case, the yield is used as a signpost to potentially under- or over-valued shares, and not explicitly as a guide to attractive dividend plays.

But while dividends are deliberately under-represented in the StockRanks, you could argue that the ranks bake in a lot of implied dividend information. The Quality Rank, for instance, uses both the Piotroski F-Score of financial health and the Altman Z-Score of bankruptcy risk. Interpretations of both these scores are used by investment bank Societe Generale as ‘quality’ filters in their Quality Income index - a successful high yield, high quality strategy. In addition, the Quality Rank tends to be higher in stocks with a track record of strong profitability and cashflow generation. These are items that income investors look for.

Equally, 50% of the Momentum Rank is devoted to ‘earnings momentum’ factors like…