Anxiety is a thin stream of fear trickling through the mind. If encouraged, it cuts a channel into which all other thoughts are drained.Arthur Somers Roche

Once upon a time, in the good old days, before QE changed everything, any signs of strength from copper could be construed as a sign that the economy was on the mend. After QE, this story came to an end, and a new reality came into play. The Fed manipulated the markets in favour of short-term gains through what could be determined as borderline illegal monetary policy; a policy that has maintained an ultra-low interest rate environment that favours speculators and punishes savers.

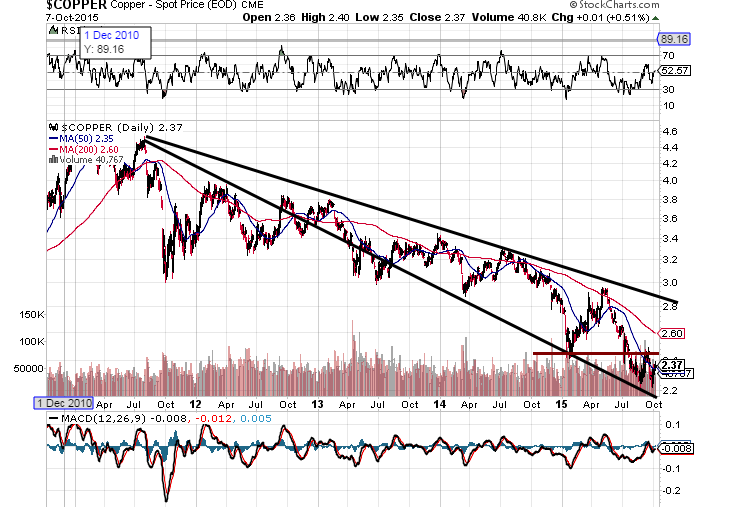

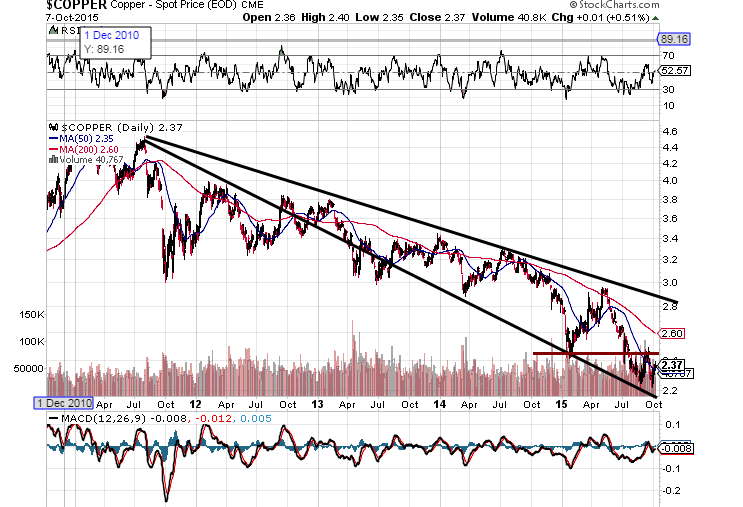

In the past, the financial markets would have marched more or less to the same drumbeat as copper. The chart below illustrates that this no longer holds true. Instead of crashing with copper, the financial markets soared to new highs.

What will unfold when copper does finally put in a bottom? Will the financial markets rally in unison once again with Doctor copper, or diverge as they have done for the past several years. Copper is issuing rather strong signs that a bottom could be close at hand. Our, trend indicator has not turned bullish yet, but it is dangerously close to issuing a bullish signal. There are, however, several technical indicators flashing positive divergence signals, and this could be construed as a bullish development.

The technical outlook for Dr Copper

Failure to hold above 2.40 will most likely result in a test of the 2.20 ranges. The ideal setup would be for copper to trade to new lows, and trigger a buy signal in the process. Generally speaking, the elite players love to create the illusion that the market is ready to break out. This ploy is known as a head fake; a move set to fool regular market technicians and the masses into thinking a bottom is in place. If you take the time to look at long term charts, you will see how splendidly this ruse has worked over the decades. The market in question does initially rally, but then it breaks down, the early bulls panic and dump everything. This usually triggers a fast move to new lows and then the smart money rushes in and starts to buy,…