The Board of Dunedin Enterprise announced this morning that they would be seeking approval from shareholders for the “managed wind-down” of the Trust. Given poor performance, shareholders seem likely to welcome this change. Can we make money from this opportunity as the discount to NAV is closed?

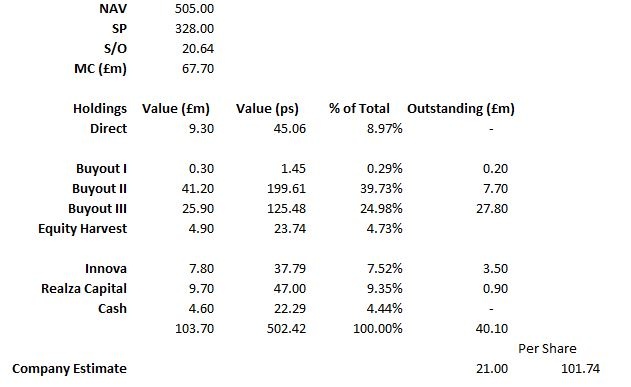

The NAV given at last month’s final results was 505p, the share price is 328p offering a discount of 36%. If the gap is closed this would represent a potential gain of 56%.

The majority of the company’s portfolio is comprised of investments in Dunedin-managed funds.

The largest investment is the Dunedin Buyout Fund II, worth £41m. The sale of CitySprint this February generated net proceeds of ~£19m. This was a big holding for the Fund so it looks like they are on course to close in September this year, as planned. However, Dunedin Enterprise only hold 16% of this fund. Even if they vote for liquidation, it is possible the Fund is extended by the other LPs (although unlikely given the weak performance)

The investment in Dunedin Buyout Fund III is worth £26m and is still in the investment phase. Management seem to expect that the Fund will call on a good portion of the outstanding commitment and this fund won’t liquidate until 2022.

Total outstanding commitments are expected to drain ~100p/share from the company.

The discount here is large but this reflects the difficulty of liquidating investments and the poor return on money trapped in Funds (Dunedin has a poor record).

By the end of 2016, it is conceivable that ~290p of realizations can be achieved, 88% of the current share price, but then we have to subtract 101p of outstanding commitments so it is more like 189p.

In theory, this value doesn’t go anywhere. We are paying another £21m into a Fund, that Fund will invest that money, and so we should get at least £21m back. The problem is time. Six years will pass before we get the money back. At worst, we may get back less than we put in (Dunedin have a record of taking a £1 and turning it into 70p).

The value attributed to the stub in Dunedin Enterprise, all the stuff that can’t be liquidated by the end of this year and the outstanding commitment, is 139p. Management say this stuff is actually worth 311p. This sounds like a decent return but over six years, this is only 14%/year. I…