Okay, so perhaps Egypt (WEEM) is not seen as the most improtant asset in the Aminex portfolio but I thought it woudl be interesting to point out some developments there.

The main partner is Groundstar Resources, (TSX-V GSA) Aminex have the 10% interest freee carried through to commercial production IIRC. The first wells havent found anything but, in the IMS: http://www.investegate.co.uk/Article.aspx?id=200905190700114549S there was a very short mention of Egypt:

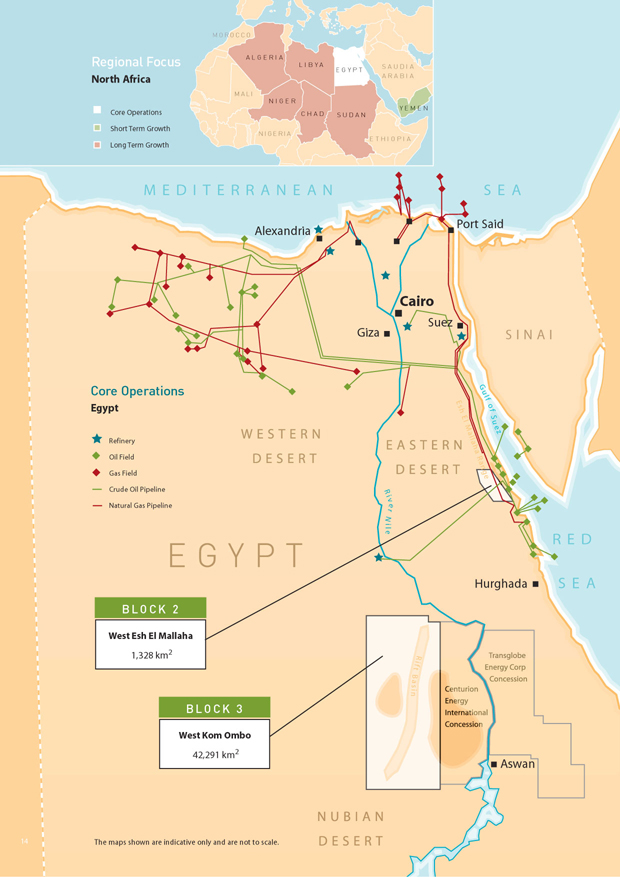

EGYPT

West esh el Mellahah Block 2 ('WEEM-2'), onshore Gulf of Suez:

One or more further exploration wells will be drilled in 2009. Aminex has a 10% beneficial interest in WEEM-2 and its share of costs is carried by other partners through to first commercial production.

WEEM-2 is operated by Aminex Petroleum Egypt Ltd., in which Aminex is a shareholder.

Now one of the majorr concerns about this has obviously been the ability of the partners to fund any new wells. It is therefore interesting to note that GSA have been very busy in recent weeks:

Firstly they reduced their interest in their property in Guyana to a 10% carried interest (to first commercial production) via a sale of part of their interst to CanacolL

http://www.groundstarresources.com/news/news.php?newsID=694

Now they have completed a funding issue:

Oddly that isnt on the website yet as it was only issue dlate last night:

Groundstar Resources Limited ("Groundstar") (TSX VENTURE:GSA) is pleased to announce that it has closed its previously announced non-brokered private placement (the "Offering") of 13,500,000 common shares ("Common Shares") at a price of $0.15 per Common Share for aggregate gross proceeds of $2,025,000. A finder's fee (the "Finder's Fee") of $191,610 was paid, equal to 10% of the gross proceeds raised on 12,774,000 shares by a finder (the "Finder"). In addition, the Corporation issued common share purchase warrants (the "Finder's Warrants") to the Finder to purchase 12,774,000 Common Shares. The Finder's Warrants will entitle the holder to purchase one Common Share at an exercise price of $0.16 for a period of five (5) years from date of closing of the Offering.

Proceeds from the Offering will be utilized to fund ongoing exploration and development activities in Groundstar's high potential blocks in Egypt, Kurdistan region of Iraq and for general corporate purposes. The Common Shares and Finder's Warrants issued upon closing of the Offering are subject to a…

.JPG)