The purpose of this article is to set out an "emerging market" investment thesis that I understand a number of Stockopedia contributors follow, and allow for discussion and investment ideas within that thesis. Here in the UK and, I believe, in many "developed economies" (including the US, Eurozone and Japan) we have a pretty poor view of the economic outlook, as reflected in stock markets in those economies. What many fail to realise, however, is that large parts of the rest of the world do not see things that way. I am fortunate to have relatives and investing colleagues that are either based in "emerging economies" (EEs) or have recent direct experience of them. The message I am hearing is that whereas we experienced a "global financial crisis" (GFC) in the developed world, the GFC had relatively little impact on the emerging economies, where it was experienced as little more than a blip on a path of rapid growth which is now continuing.

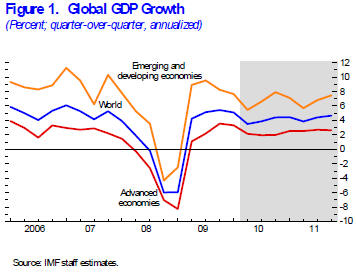

The IMF's World Economic Outlook, updated July 2010, supports this thesis with the following historic & forecast chart:

I'll highlight near term growth forecasts for some selected EE countries:

| Country | 2010 % GDP Growth | 2011 % GDP Growth |

| China | 10.5 | 9.6 |

| India | 9.4 | 8.4 |

| Brazil | 7.1 | 4.2 |

| S Korea | 7.4 | 8.0 |

Many Stockopedia contributors and I invest in natural resource companies. These are indirect plays on EE growth, as a driver for demand for natural resources, as the slow pace of growth in developed economies and a strong push towards more efficient consumption of natural resources is unlikely to deliver much demand growth (if any) from those quarters.

However, it also possible to invest directly in these EE countries. In recent years the emergence of ETFs investing directly in EEs has made such investment much easier for retail investors than it was in the past. The relatively low charges of such index tracking ETFs also help to minise "frictional costs" for the investor. Some examples of such ETFs are:

- Ishares Ftse Xinhua 25 (LON:FXC)

- Ishares Msci Brazil (LON:IBZL)

- Ishares Msci Korea (LON:IKOR)

Further details of these ETFs can be found here: http://uk.ishares.com/en/rc/funds/overview/EMEQ_CNTRY. Investment trusts such as JPMorgan Indian Investment Trust (LON:JII) also offer another means of gaining exposure.

Over…