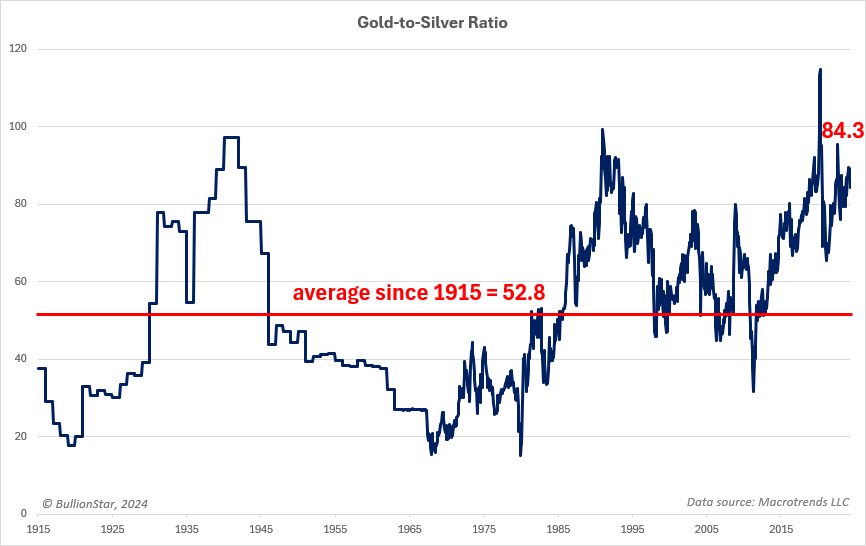

Silver market observers will have likely noticed Eric Sprott’s open letter calling silver miners to arms last November. Mr Sprott urged the miners to think about bit more deeply about their precious product, given his concerns about an unhealthy disconnect between the physical and paper silver markets. Silver miners and silver investors were potentially suffering the results of this disconnect and a resulting lower silver price.

Mr Sprott has concerns about manipulation in the paper silver market where over a billion ounces are traded each day. Sprott Asset Management have been pointing out for some time that this is perverse, when there are barely half a million ounces of physical silver available each day for investment. The far larger paper market, which bears no relation to the physical market, is where price discovery occurs in setting the silver price.

Paper silver versus silver bullion

I think we have a bit of a voice in the silver market, and the reason for the letter was just the simple analysis that the paper traders were determining the price…and why should you physical silver producers let that happen? …That’s really why I went there. I thought that if we could just tip a few of these silver producers around to thinking about what’s going on in the market, and who’s determining the price, maybe we’ll let the physical markets determine the price instead.

Eric Sprott had argued that silver miners should consider the benefits of saving in silver bullion.

“And that was the primary thing - would you guys please think about what’s happening in your silver market! Plus the fact that it got bombed last year, and are you just going to sit back and lose $25 an ounce that you might otherwise be making, or are you ready to take a stand here? The other very easy argument for me, is when you have your money in a bank, you get no return… I happen to be of the view that having money in the bank is a dangerous thing! And you know they keep bailing out the banks all the time such as the recent G6 announcement that we’ll give unlimited loans to banks: well, they had to give unlimited…