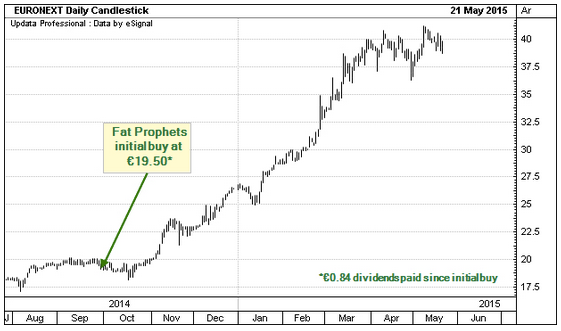

Euronext is a pan-European exchange that includes Paris, Brussels, Amsterdam and Lisbon. The group was listed in June 2014 at €20 and recently reached around €40. Improving Eurozone equity markets have generated brisk trading and the ongoing economic recovery suggests that this is likely to continue.

Euronext is the result of European integration with the ambition being to create a single continental bourse for stocks and derivatives. The group was formed in 2000 through the merger of the Paris, Brussels and Amsterdam exchanges.

Euronext was subsequently listed in 2001 and merged with the Lisbon stock exchange in 2002. The New York Stock Exchange bought the company in 2007 and Intercontinental Exchange acquired the combined group in 2013.

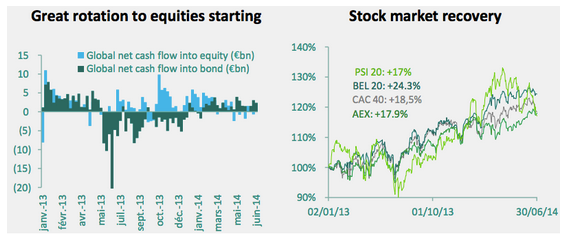

The merry-go-round resulted in Euronext being spun off in June 2014 just as European markets were improving. The introduction of Eurozone QE in 2015 has further bolstered European markets in part due to the resultant euro weakness.

Euronext’s market backdrop in June 2014

Source: Euronext investor presentation

Euronext is currently the second largest European exchange group by cash trading volume after the London Stock Exchange. The group is the third largest in European derivatives after Deutsche Boerse and ICE Europe.

Listed market exchanges have outperformed the general equity market if they are strong enough to attract growing volumes. However, exchanges have also tended to be highly cyclical as trade volumes slump in equity bear markets.

Euronext’s modest listing valuation and positive trading conditions have seen the shares double in less than a year. The group offer exposure to recovering European equity markets and improving investor sentiment.

Euronext’s drivers

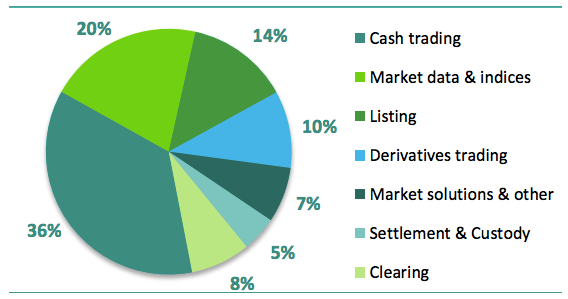

In 2014 cash trading made up 36% of Euronext’s revenue with the group enjoying a 65% market share in continental Europe. Over 90% of cash trading is equity driven with the rest coming from ETF’s, structured products and bonds.

Listing revenue made up 14% of Euronext’s revenue in 2014 and is also driven by market activity. IPO and follow-on listing fees are over a third of listing revenue and have increased as stronger markets support new capital raising activity.

Euronext’s €458m third party revenue in 2014

Source: Euronext investor presentation

Source: Euronext investor presentation

Euronext saw total third party revenue rise 9% in 2014 to €458m as momentum picked up in the second half. In the first quarter of 2015 the pace continued with a 9.6% increase on a…