Looking back at some of the companies I've covered, I noticed something interesting - Finsbury Food, who I talked about in January, have made a big change. They've sold off their free-from business for a consideration of £17.7m up front and £3m in two years time. £21m is clearly a significant sum for a group that was trading at a market cap about that not so long ago, and the figure represents about a third of the group's total enterprise value. Here's what piqued my interest, then - they've sold off a division for about a third of their enterprise value. What percentage of their operating profits was it making? Well, at first glance, less than 20%. Selling 20% of your profits for a figure representing 33% of your company's apparent 'value' is clearly good business. Alas, as seems to be the norm with investing, it's not as easy or as obvious as it first seems. If you're less interested in my meandering, tentative logic, and more interested in the results, feel free to skip to the bottom few paragraphs.

Looking back at some of the companies I've covered, I noticed something interesting - Finsbury Food, who I talked about in January, have made a big change. They've sold off their free-from business for a consideration of £17.7m up front and £3m in two years time. £21m is clearly a significant sum for a group that was trading at a market cap about that not so long ago, and the figure represents about a third of the group's total enterprise value. Here's what piqued my interest, then - they've sold off a division for about a third of their enterprise value. What percentage of their operating profits was it making? Well, at first glance, less than 20%. Selling 20% of your profits for a figure representing 33% of your company's apparent 'value' is clearly good business. Alas, as seems to be the norm with investing, it's not as easy or as obvious as it first seems. If you're less interested in my meandering, tentative logic, and more interested in the results, feel free to skip to the bottom few paragraphs.

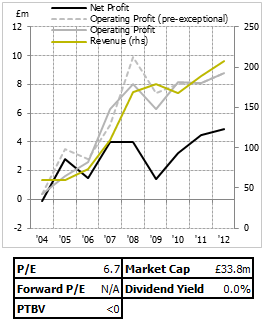

With that little tidbit in mind, here's the goal: we want to take Finsbury's financial statements from last year, and adjust them as if the free-from segment never existed. We can then whack the £21m cash onto their balance sheet, calculate all our investing metrics as normal, and see what happens. We're trying to prove or disprove my hunch - that the sale is a positive for the value of the business, even on top of the 17% share price spike that hit when the sale was announced.

Only, it's slightly more complicated than it might appear at first. We need to find the information from the RNS statement which is relevant to our interests; the section on the segment's financial performance. FIF gives us 4 figures - revenues of £28.5m, PBT of £0.6m, net assets of £6.1m and a fourth figure - which seems to basically represent operating profit - of £1.4m. A straight comparison with last year's annual report is difficult, particularly because the free-from businesses aren't a segment in themselves - they're bundled with the bread business. That means we need to attempt to unbundle them. There's also a segment entitled 'group operations' which muddies the waters slightly, defined as:

A purchasing premium of 2% is charged…

.png)