Mining behemoth Anglo American (AAL) is suffering a crisis of confidence as its market capitalisation slip from being a $47.6bn business and heading towards £6bn!

In share price terms, the company was once valued at £35/share, now at a depressed £4.40/share, as we speak.

I feel this company is oversold, and you should own some in your portfolio.

Let’s begin:

1. Better asset quality

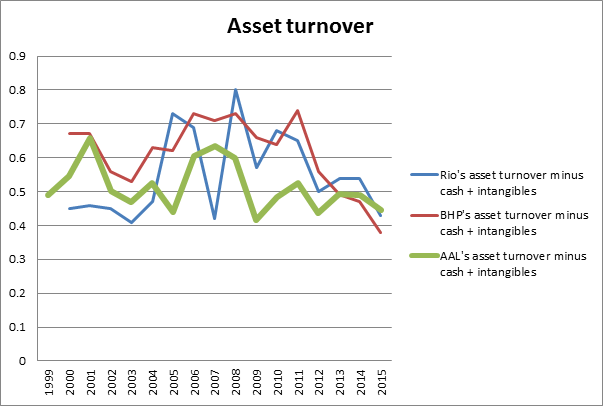

Source: Annual reports of BHP, RIO + AAL.

When compared to bigger rivals like BHP and Rio Tinto, Anglo American asset turnover is no worse than the two biggest miners in the world, if not slightly better.

It’s important to have a higher asset turnover because it means these assets are generating sales relative to the value on its assets in its books.

Right now, Anglo American’s asset turnover is stabilising because the company wrote off its assets value. That means the company has ‘asset stability’ unless commodities prices decline further.

As investors, we need to see stability in businesses that we invest and not continuing deterioration in a company’s assets base.

2. Superior short-term cash vs. non-liquid assets

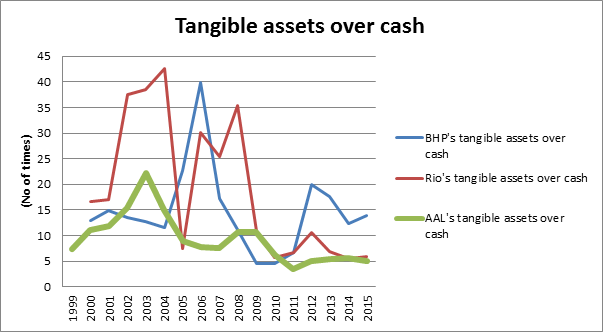

Source: Annual reports of BHP, RIO + AAL.

Imagine owning a barber shop and you borrowed money to renovate the place to make it assessable and comfortable for your customers. For a while, you were earning money to pay off your loan.

Then two months later, a well-known barber shop is set up near your street. People start choosing to get a haircut there instead of your place. Now you start losing your cash inflow to pay off your loan.

The same thing is happening to the miners but in different circumstances. Instead of a steady increase in supply it became a rapid increase in supply and production.

Why?

Because most (if not all) miners bought into the ‘China will grow forever’ story. Now, China is slowing dramatically it caught the miners out as supply outstrips demand, meaning collapsing commodities prices.

One way to measure a miner’s liquidity is to divide its most illiquid assets or tangibles against its most liquid asset, cash!

The lower the multiple, the more conservative the miner is and ready to meet any short-term challenges. Anglo American is the more ‘cash conservative’ miner (see above chart).

Sometimes miners go on an acquisition spree buying overvalued assets; this creates a lot of intangibles like goodwill. But all three miners have…