While ultra-low interest rates are a boon for mortgage borrowers, they are a curse for the legions of savers who have seen their cash returns collapse.

Six years into supposed economic recovery after the seismic shock of the global financial crisis, the FTSE 100 index has gained 80% from the 2009 low to the present date.

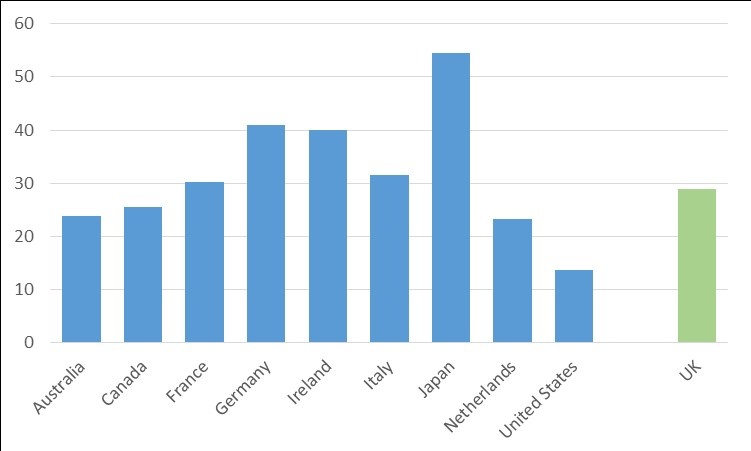

You might have thought that retail investors would have been enjoying this impressive stock market performance. But in fact, not nearly as much as you might have thought, because according to the OECD, UK households have continued to hold very high levels of cash – some 29% of all their financial assets (excluding housing), in common with retail investors across Europe and Japan (Figure 1).

1: UK Households Still Have 29% of All Financial Assets in Cash

Source: OECD, National Accounts at a Glance, 2014

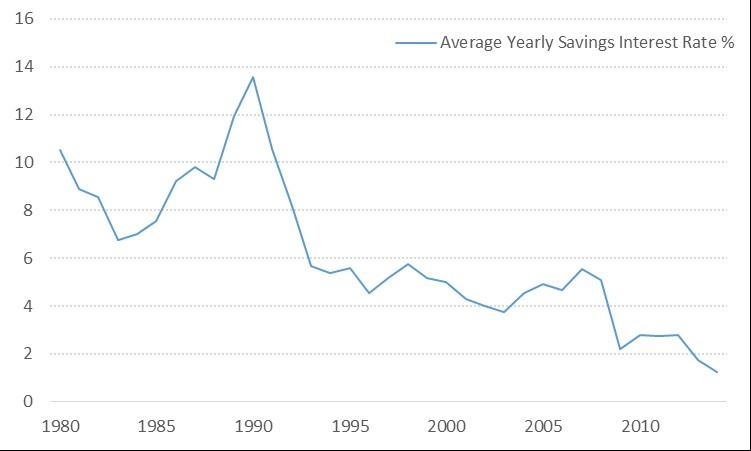

Clearly, the scars of the last two bear markets in 2000 and 2008 still run deep. But instant-access cash savings rates have never been as low as they are today in post-war Britain: in fact, they have been on a steady decline really since the height of the last property boom in 1990, falling from a heady 13.6% to 1.25% on average today (Figure 2).

2: Cash Savings Rates Have Not Been This Low in Post-War Britain

Source: swanlowpark.co.uk

It is obvious that a 1.25% interest rate is not enough to preserve the value of your savings in real terms even when shielded from tax in a cash NISA, when average UK inflation has run at 1.8% on the CPI measure this year, and an even worse 2.5% on the old RPI measure.

If you insist in keeping some of your savings in cash, then I can recommend hunting out Regular Saver bank accounts at HSBC, First Direct, Lloyds Bank and Nationwide which all pay up to 6% p.a. on regular savings of up to £250 per month. Attractive interest rates to be sure, but only available on relatively limited amounts.

Attractive Income from the Stock Market

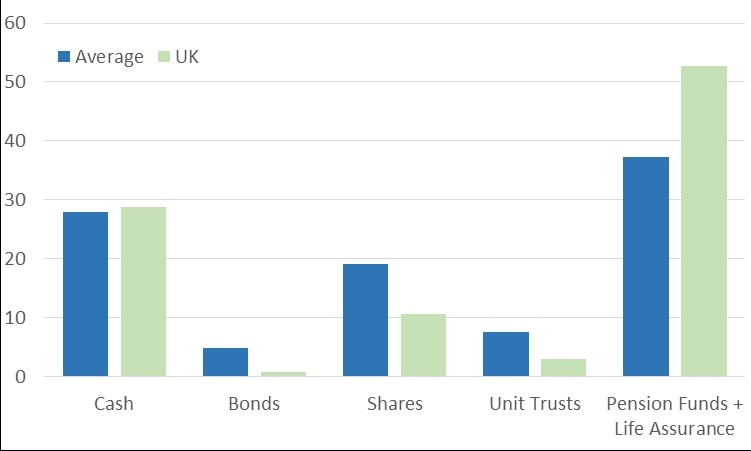

A second route to higher income is through the stock market, where dividend payments have in general been growing consistently since 2009. UK households are relatively under-invested in shares at 10% of total financial assets, compared to other developed countries (Figure 3).

3: UK Investors’ Exposure to Shares is Below Average

Source: OECD, National…