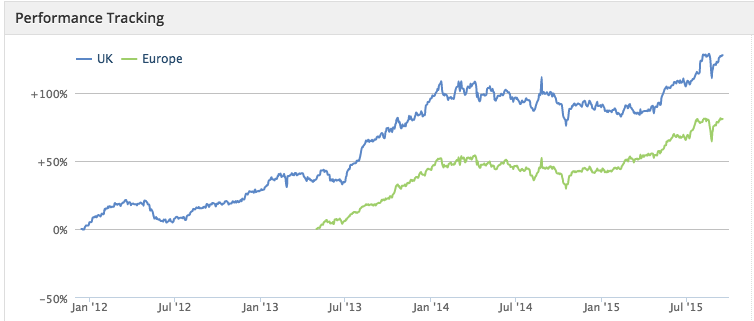

Stockopedia’s 60 guru-inspired investing strategies will be rebalanced later this month. Given the sharp market pull back one month ago, it will be interesting to see which of the screens and styles have suffered and which of them have managed to ride out the correction. What’s already clear is that in Europe, a number of Growth strategies are quickly bouncing back.

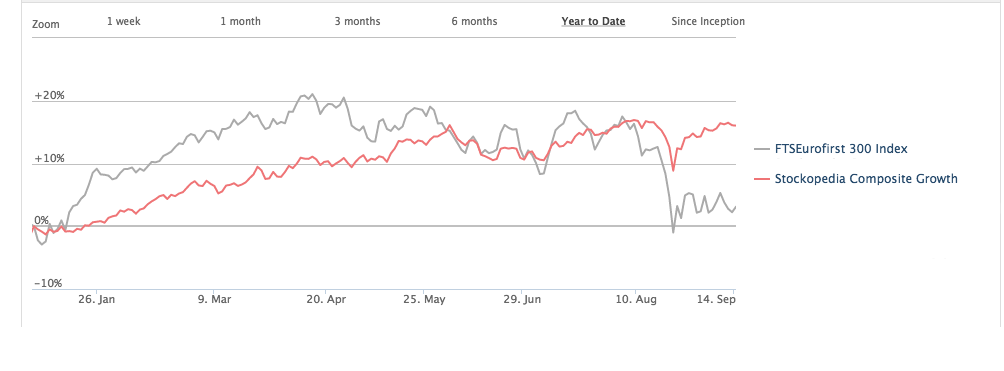

After a strong start to 2015, the FTSEurofirst 300 was hit hard by the declines in late summer, leaving it up by around 4.2% year-to-date. By mid-July, the FTSE Euromid, a benchmark of mid-cap pan-European companies, had risen by 20%. But the performance of that index is now a more modest 11.3%.

By comparison, the 10 Growth strategies tracked by Stockopedia have returned an aggregate 15.8% in Europe this year. That performance has been dominated by strategies that focus on growth at a reasonable price (GARP).

Winning GARP strategies

Leading the pack is the Jim Slater Zulu Principle strategy, which is up by 26.5% in 2015 (see the performance chart below). That’s followed by James O'Shaughnessy Cornerstone Growth (+22.1%) and the Martin Zweig Growth screen (+21.6%). These strategies combine a focus on earnings growth, positive momentum in the form of strong relative price strength and attractive valuation. The Slater and Zweig rules measure valuation using the price-to-earnings ratio, while the O’Shaughnessy screen uses price-to-sales.

Just a reminder that all Stockopedia’s guru strategy performance figures exclude trading costs and are based on quarterly rebalancing. In reality, these costs would reduce returns.

Over the past quarter the best performing share in the Zulu Principle portfolio was a small French IT business called Octo Technology, which gained 35.3%. There was also a 28.4% rise at Swedish shop fitting company ITAB Shop Concept.

The Cornerstone Growth portfolio did well from a position in a German online financial services firm called Hypoport, which has risen by an impressive 45% since the end of June. It also saw a 30% gain in German bio fuels distributor, Verbio Vereinigte Bioenergie.

It’s worth noting that the European guru strategy portfolios include UK shares. With that in mind, it’s interesting that six of the 22 holdings in the Martin Zweig portfolio are major UK housebuilders.…