It’s been eight weeks since we completed the quarterly rebalancing of Stockopedia’s 65 GuruModel investing strategies – but it has been an uncertain period for the market and for investors. With growth and momentum strategies blossoming during the bullish early months of this year, the portfolio rebalancing came just as a long awaited correction in prices appeared to be unfolding. Those declines however, have been clawed back over the summer – leaving investors in the dark about when or if a meaningful pull back in prices will eventually occur. So how has this affected our guru-inspired screen performances?

So far this year the GuruModels have provided a textbook example of the cyclical nature of investing. At the turn of 2013, it was deep value strategies such as Ben Graham’s ‘Net Nets’ that were making the running. Bargain bucket screens like this tend to throw up cheap, obscure shares that most people wouldn’t touch during a bull market but the rising tide of optimism early in the year floated these boats too, which meant Net Nets was a winning strategy in Q1.

It was all change as we headed in to spring, with momentum and growth strategies leading the pace, leaving some value screen struggling. Portfolios based on earnings upgrades and price momentum did exceptionally well, indeed the Earnings Upgrade Momentum screen has proved to be the best performer of the year so far, with a return of 38.6% against 9.6% for the FTSE 100 at the time of writing. Growth investing screens were also emerging as potentially strong performers, with strategies from Charles Kirkpatrick and Martin Zweig breaking out as the mid-year approached.

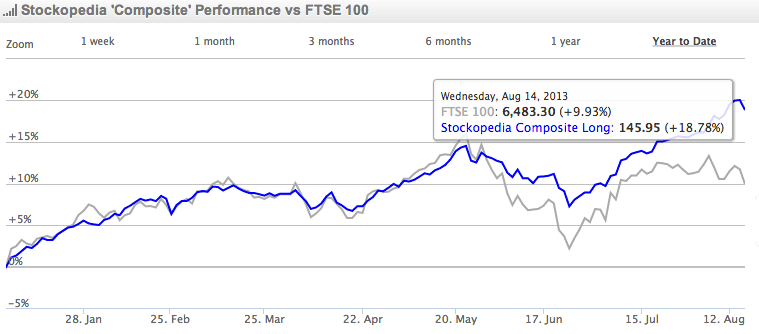

Interestingly, as this chart shows, the GuruModels were able to keep pace with the market as it accelerated during the first six months. But when May’s pull back hit, those screens were nowhere near as badly affected… and they haven’t looked back since. In the four week market decline following May 22, the Earnings Upgrade Momentum portfolio amply illustrated this trend, initially losing 9.2% of its value only to bounce back by 11.4%. By comparison, the FTSE fell by 11.3% but has only managed to rebound by 9.5%.

But it isn’t just momentum screens like earnings upgrades that are now bossing the GuruModel performances; growth strategies such as Bill O’Neil’s CAN-SLIM are also…