The mining sector faces headwinds from falling commodity prices. The information analysis firm, IHS, forecasts another tough year for commodities prices as Chinese economic growth targets have miss targets. However, the market has a tendency to overreact to bad news, meaning that good quality stocks can start to trade at bargain prices. Stockopedia's GuruScreens are a useful tool to hone in on these bargains. So let's take a look at mining stocks which currently qualify for the GuruScreens.

Rio Tinto (RIO)

2015 has brought a mixture of good and bad news for Rio Tinto shareholders. Towards the end of March, the Mongolian Government announced its decision to allow Rio Tinto to proceed with plans to expand its Oyu Tolgoi copper and gold mine. Rio Tinto and the Mongolian Government had previously been at an impasse over the development of the mine. That was the good news. That bad news was that Glencore Plc, the Anglo–Swiss mining giant, may be unable to takeover Rio Tinto. Rio Tinto could have become significantly more expensive were Glencore (GLEN) to attempt a hostile takeover. However, a significant fall in Glencore's share price may mean that the company may be financially constrained from executing the takeover.

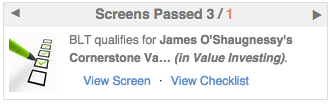

BHP Billiton (BLT)

Towards the end of 2014, the Anglo-Australian mining giant - BHP Billiton - reported that although iron ore had fallen by nearly 40% during 2014, the firm had managed to step up production by 9% in the quarter ending September 2014. The firm also claimed that it remained on track to boost steelmaking production by 11% over the financial year. It also maintained its two-year guidance to grow output by 16% by June 2015. BHP's share price also rose in March, after the firm revealed that the company had raised A$1 billion in debt on the Australian bond market.

Towards the end of 2014, the Anglo-Australian mining giant - BHP Billiton - reported that although iron ore had fallen by nearly 40% during 2014, the firm had managed to step up production by 9% in the quarter ending September 2014. The firm also claimed that it remained on track to boost steelmaking production by 11% over the financial year. It also maintained its two-year guidance to grow output by 16% by June 2015. BHP's share price also rose in March, after the firm revealed that the company had raised A$1 billion in debt on the Australian bond market.

BHP Billiton has announced plans to demerge a group of assets to create an independent global metals and mining company, South32. The spinoff is scheduled to make its debut on the Australian Stock Exchange in 2 June - providing BHP Billiton shareholders approve the demerger on 6 May. However, the company's share price dipped at the beginning of April,…