Can anyone beat the market? The FTSE 100 broke 7000 for the first time last week and has continued to move ahead, reaching an inter-day high of 7065 on 24 March. Share prices reached higher as news emerged that UK inflation had fallen to 0% in February, the lowest level since records began.

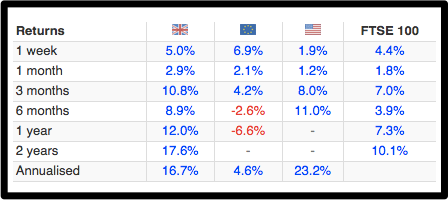

The Footsie is going strong. However, one of the GuruScreens which has recently beat the market is the James O'Shaugnessy Cornerstone Value Screen. As you can see from the table below, the UK edition of the screen has consistently beaten the FTSE 100 over the last week, month and year. The screen seeks to identify larger cap companies that are generating strong revenues and cashflows, but are still relatively cheap. Let's take a closer look at two companies that qualify for the screen.

M&S

M&S has been making headlines recently, but perhaps for the wrong reasons. Just two weeks ago, the company was accused of labour abuses in Cambodia. Furthermore, in early March, the company announced a change in its dividend policy. Shareholders could exchange a dividend payment for a discounted gift card. M&S's share price declined from £5.05 (9 March) to £4.93 (13 March) although the price has since climbed to a 52 week high price (£5.42). Why has the share price recovered? Despite M&S's new dividend policy, the firm might be generating enough cash to support its dividend. Operating cash flows amounted to 77p per share (TTM) whereas the company is expected to pay an 18p dividend in 2015. This would give M&S a 3.5% dividend yield. The company has also managed to grow revenues each year since 2009, while operating margins have remained steady, albeit at around 7%. The firm's overall StockRank is 96.

M&S has been making headlines recently, but perhaps for the wrong reasons. Just two weeks ago, the company was accused of labour abuses in Cambodia. Furthermore, in early March, the company announced a change in its dividend policy. Shareholders could exchange a dividend payment for a discounted gift card. M&S's share price declined from £5.05 (9 March) to £4.93 (13 March) although the price has since climbed to a 52 week high price (£5.42). Why has the share price recovered? Despite M&S's new dividend policy, the firm might be generating enough cash to support its dividend. Operating cash flows amounted to 77p per share (TTM) whereas the company is expected to pay an 18p dividend in 2015. This would give M&S a 3.5% dividend yield. The company has also managed to grow revenues each year since 2009, while operating margins have remained steady, albeit at around 7%. The firm's overall StockRank is 96.

Imperial Tobacco

Imperial Tobacco qualifies for the James O'Shaugnessy Cornerstone Value Screen and has a StockRank of 93. The company has faced headwinds as geopolitical instability in the Middle East, coupled with a strong pound, have both worked to drive revenues down. Indeed, the company generated £26,625m in revenues in 2014 - down from £28,269m the year before. Although revenues have fallen, earnings per share figured notched up from £1.71 (2013) to £1.73 (2014).

Imperial Tobacco qualifies for the James O'Shaugnessy Cornerstone Value Screen and has a StockRank of 93. The company has faced headwinds as geopolitical instability in the Middle East, coupled with a strong pound, have both worked to drive revenues down. Indeed, the company generated £26,625m in revenues in 2014 - down from £28,269m the year before. Although revenues have fallen, earnings per share figured notched up from £1.71 (2013) to £1.73 (2014).

This was…