Heineken is the world’s third largest brewer by volume with it coming in behind AB InBEV and SAB Miller. The group is benefiting from its exposure to developing markets, a strong innovation rate and premium beer brands. A large family shareholding in Heineken has led to a focus on the long-term.

Adriann Heineken founded Heineken in Amsterdam in 1864 and as such it is a European company with a long pedigree. Tourists to Amsterdam can visit the Heineken Experience where Heineken was brewed for over a hundred years.

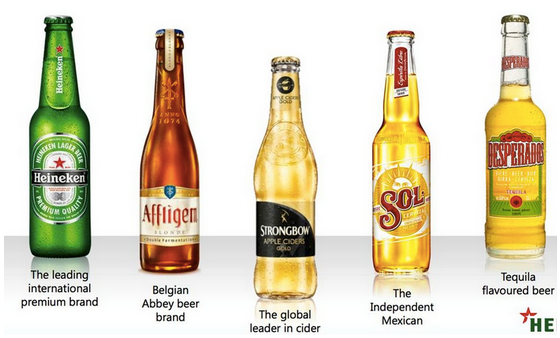

Heineken’s global brands

Source: Heineken investor presentation

The longevity of the business illustrates the attraction of consumer staple groups for investors. They are generally able to withstand the test of time and therefore compound value over the long-term.

In terms of the brewing industry and volumes have been fairly subdued in Western countries given the shift towards healthier lifestyles. However, companies with premium brands and new products have fared well.

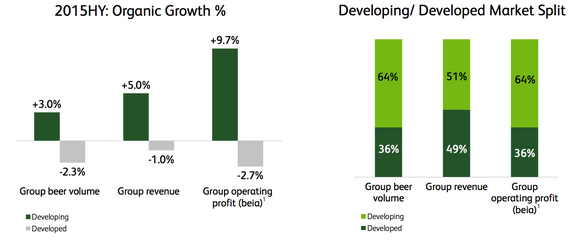

Developing countries are seeing volume growth and have attracted significant investment from the industry. Heineken is well positioned with 64% of beer volume and profits generated from developing markets in the first half of 2015.

Heineken’s developed & development market split

Source: Heineken investor presentation

In the first half of 2015 beer volumes in developing markets rose by 3% in the while they declined by 2.3% in developed markets. The weakness in developed countries reflected the tough comparatives given the football World Cup last year.

Among the developing markets the Asia Pacific region was a key area of strength with beer volumes 6.1% higher in the first half. Africa Middle East saw 2.8% volume growth in the period and Central & Eastern Europe saw a 2% decline.

Total revenue in H1 2015 came in at €10.9bn with the largest contributor Western Europe at €3.7bn. The Americas generated €2.98bn, Africa Middle East €1.6bn, Central & Eastern Europe €1.58bn and Asia Pacific €1.35bn.

As such Heineken has a diversified position in developing markets and should be able to offset weakness in any one region. By contrast the world’s fourth largest brewer, Carlsberg, is heavily exposed to Eastern Europe and in particular Russia.

Heineken’s offering: premium & innovation

Turning to the product and premium brands and product innovation have underpinned sales momentum and margins. In the first…